Cake Equity

Telling Your Story

Capital raising can be one of the most challenging aspects of entrepreneurship. However, it can also provide the founder with the capital to bring her/his idea to life and grow the business.

Telling your story is a key part of this process, particularly in the beginning. I spoke to Jason Atkins and Kim Hansen, co-founders of Cake Equity, to learn more.

Cake Equity helps startups manage their equity, raise capital and issue options, thereby making equity a ‘piece of cake’.

Their business has helped numerous startups through the capital raising process. I am grateful for their insights.

This article will briefly discuss the capital raising process, followed by how Cake Equity tells its story and Jason’s approach to valuation.

Cake Equity’s story is a case study of how the founders’ journey and mission are the enduring pieces of a startup’s story that define its unique approach and the markets it can serve over time.

Index

1) The Capital Raising Process

2) Telling Your Story

3) Cake Equity’s Story

4) Valuation

The Capital Raising Process

Segment Key Points

Capital raising has multiple steps. A key step at the beginning of this process is telling your story.

Cake Equity’s software has helped numerous startups through their capital raising, and the founders have great insights on how to tell a startup’s story.

In this article, I will break down the Cake Equity story so that founders can apply this to their businesses.

Cake Equity breaks down the capital-raising process into the following phases:

Cake Equity has a wealth of capital raising resources on its website for founders, including a Capital Raising Toolkit here.

There are 2 things to note from the capital-raising process.

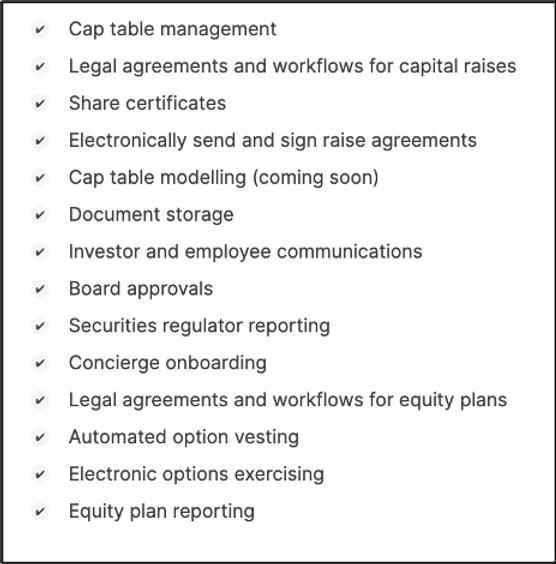

The first is to note the level of administration involved. Cake Equity’s SaaS solution streamlines this process by:

Helping founders manage their capitalisation tables (cap tables). This is a record of the company’s share ownership. An accurately updated cap table is essential in capital raising as it helps investors work out their potential ownership stakes and founders to understand dilution. More on this here.

Generating and storing important document templates such as legal agreements, share certificates, securities regulator reporting etc.

The second is the importance of telling your story, which is the focus of this article.

Telling Your Story

Segment Key Points

Telling your story is crucial in attracting investors, particularly at the early stages.

Your story should give the investor a clear picture of what you do, the problem you are solving and how you stand out.

While the product and market can evolve over time, the founders’ journey and mission are the enduring pieces of a startup’s story that define its unique approach and the markets it can serve.

According to YCombinator, most seed rounds get raised based on the quality of the founders and the story they tell about their venture. Often this can be more important than the business model or product. As Steve Jobs once said:

‘The most powerful person in the world is a storyteller.’

Steve Jobs

So how does a founder tell her/his story? Let’s go through the Cake Equity story by asking the following questions:

What do you do?

Briefly describe what your business does and for whom. Cake Equity’s software helps startups (pre-seed to series B) manage their equity by simplifying the issuing and transferring of shares, options and notes.

What is the problem?

Describe the problem your business is trying to solve for your customer. Investors are trying to understand if there is a real need for your solution. The founder should show a deep understanding and empathy for the customer.

Jason and Kim did grassroots research by speaking to 30 customers about the customer journey. These were followed by conversations with people that have a sophisticated understanding of the fund-raising problem, such as Aaron Birkby and accelerators like River City Labs.

They received consistent customer feedback that this was a manual and painful process. Specifically, it costs founders ‘$20-30k for a $2m raise and 2-3 months of administrative work’.

A high degree of customer empathy came across clearly in my conversations with both Jason and Kim. This can also be seen in the numerous resources on their website and webinars on the topic.

What is the size of the market?

The preferred way to do this is with a bottom-up approach. Key business model assumptions such as customer numbers, average price, distribution points etc., are used to estimate the market size. See this link for more detail.

Importantly, there should be a balance here. The addressable market needs to be large enough to build a sizable business. However, it should also be sufficiently targeted for the startup to stand out.

Jason and Kim achieve this balance by targeting a specific initial market (startups from pre-seed to series B) with a product offering that has significant scope to grow, as described below.

It starts with an ambitious vision/mission to democratise equity and make entrepreneurship more accessible. Notice how this speaks to the long-term purpose of the business rather than being limited to its current offerings. For more on this and culture, see my previous article here.

Cake Equity’s initial product helped startups manage their cap table, as well as the ability to manage and store key contracts and certifications related to capital raising.

Typically, this is done manually with excel sheets and documents in different locations. Recording details of equity ownership and storing key documents on its platform allow Cake Equity to be the system of record and source of truth for its customer’s equity ownership. This is similar to how Salesforce is the source of truth for customer data.

Being the source of truth allows other features to be built using this data, such as Cake Equity’s Employee Share Option Plan feature. This raises the average revenue per customer and thereby market size.

Additionally, there is a virality/word of mouth to Cake Equity’s product. I.e. a startup’s investors interact with Cake Equity’s system (receiving share certificates, well-organised cap tables), then recommend Cake Equity to other startups in their portfolios.

As more startups sign up, Cake Equity will be able to build an ownership graph, mapping investors and equity ownership stakes.

A critical mass of startups will allow Cake Equity to service investors directly with a Fund Administration platform. E.g. a product that helps investors administer their portfolio holdings.

This turns Cake Equity into a platform that could eventually facilitate direct trading between participants. I.e. Cake Equity can match buyers and sellers of the various startup equity stakes on its platform.

Imagine trading equity stakes in startups as easily as you would on the stock exchange!

Potentially employees will be the biggest beneficiaries of this increased ability to trade startup equity. This illustrates the power of Cake Equity’s ambitious mission to make entrepreneurship more accessible.

Why Us?

On a Startup Funding Series call, Qualgro VC Partner Peter Huynh indicated that the founder and team aspect was the most important indicator of success.

Explain why this is your life’s mission by connecting to your founding journey and including experience in the space, domain expertise, IP etc. Show why your team has the skills needed to achieve this mission.

Jason’s passion for finance and innovation began at Mastercard in London. This was followed by various CFO roles, including running several capital raises. Here, he experienced first-hand how complex and time consuming this process is.

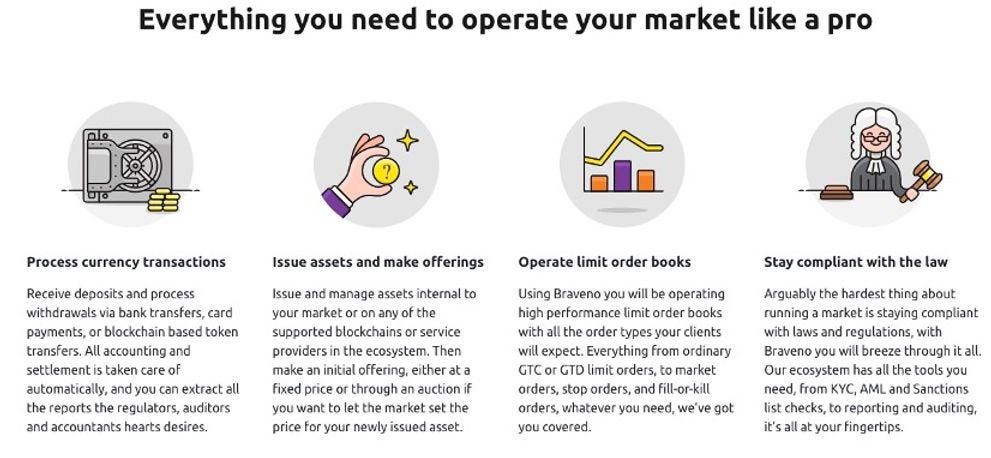

Kim has a software engineering background and comes from an entrepreneurial family. In 2014, Kim co-founded Braveno, which provides software that facilitates marketplace transactions for niche markets. I.e. software facilitating the trading of illiquid assets.

The 2 things to note are:

Braveno’s software includes key features needed to run an exchange, including issuing assets and managing order books

The software can also operate blockchain crypto exchanges. One of Braveno’s co-founders played a part in starting Etherium.

Jason and Kim met in the Gold Coast. They connected over their passion for innovation and making entrepreneurship more accessible.

They co-founded Enhanced Society, an open-source platform that helps entrepreneurs raise capital using blockchain technology.

Blockchain technology allows entrepreneurs to raise capital quickly and easily through digitising share ownership via tokenisation, as shown below.

Notice the similarities to the chart illustrating Cake Equity’s potential startup equity exchange.

Jason and Kim are now applying some of these concepts to the traditional equity space, as can be seen in their unique approach.

What is your unique approach?

Describe what sets your business apart from other solutions or the competition.

As previously discussed, Cake Equity represents an adaptation of Enhanced Society, and its unique approach reflects the automation and speed of the blockchain space.

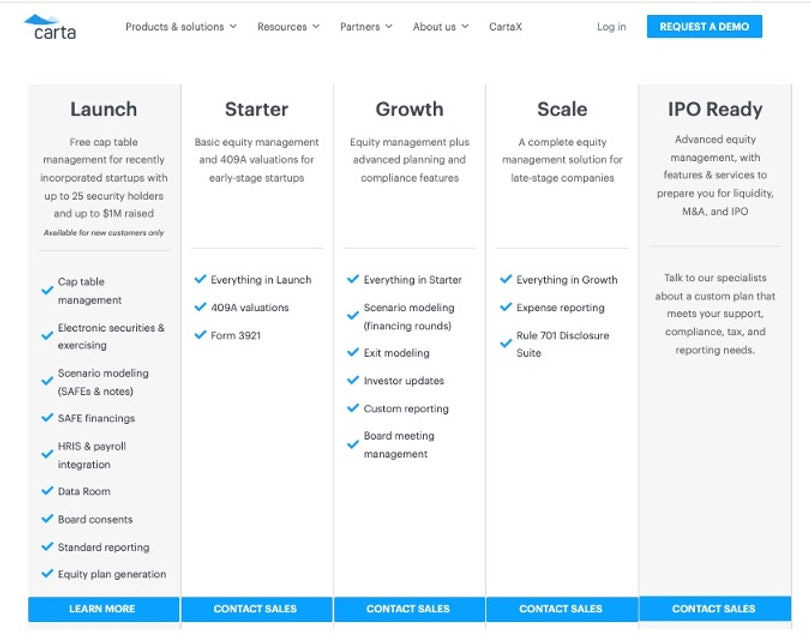

Cake Equity’s solution is designed as a product-led SaaS offering. It simplifies numerous services and features into 2 solutions. This is well suited to their target startup customers as it clearly shows the cost, and they can sign up directly on the website.

This compares to competitor Carta which focuses on larger mid-market businesses with an enterprise sales approach.

What is your traction?

Describe the key metrics that drive the growth in your business. E.g. average recurring revenue, retention etc. Use these metrics to show your growth story in simple charts.

Instead of trying to show an uninterrupted growth story, Jason recommends showing what you have learnt about your business and customers.

Help investors understand how additional funds will impact these metrics. E.g. sales efficiency, customer insights or product experiments.

Jason also recommends talking about the ‘why now’ story for the industry and how the business will be 20x its size in 5-20yrs.

Cake Equity’s Story

Let's put this together to construct Cake Equity’s story.

Cake Equity’s software helps pre-seed to series B startups manage their equity by simplifying the issuing and transferring of shares, options and notes.

There is a virality/word of mouth to Cake Equity’s product, given a startup’s investors also interact with its system and can introduce it to their other investments.

The business was founded by Jason Atkins and Kim Hansen with an ambitious mission to democratise equity and make entrepreneurship more accessible. This mission goes beyond the addressable markets of their current solution.

By recording ownership details and storing key documents, Cake Equity’s solution could eventually grow into an exchange matching buyers and sellers of startup equity stakes. Employee shareholders could be the biggest beneficiaries of this liquidity, thereby broadening access to the benefits of entrepreneurship.

The founders’ journey in the marketplace and crypto space makes them uniquely placed to build such an exchange. Cake Equity is an adaptation of businesses they have previously worked on.

Their background has influenced their SaaS product-led approach. The simplicity of this approach is well suited to their startup target market and takes advantage of their software’s virality.

Valuation

Segment Key Points

Early-stage founders should not think about valuation in terms of complex modelling and formulas.

Instead, founders should consider valuation as balancing capital requirements and the dilution they are willing to accept.

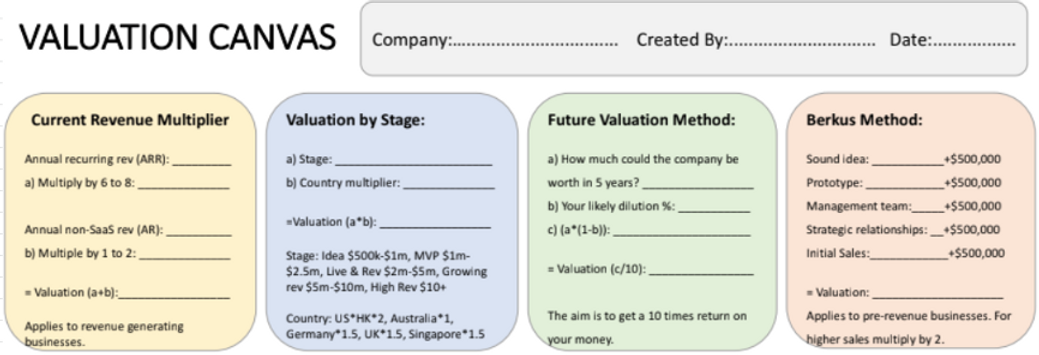

Cake Equity has several resources relating to valuation. This includes an excel sheet template with the following methods:

However, Jason advises against justifying valuations with complex models and assumptions. This mirrors Square Peg co-founder Paul Basset’s comments that ‘you’re an entrepreneur, not an investment banker’.

Instead, founders should focus on their funding requirements over the next 18-24mths and the dilution they are willing to accept.

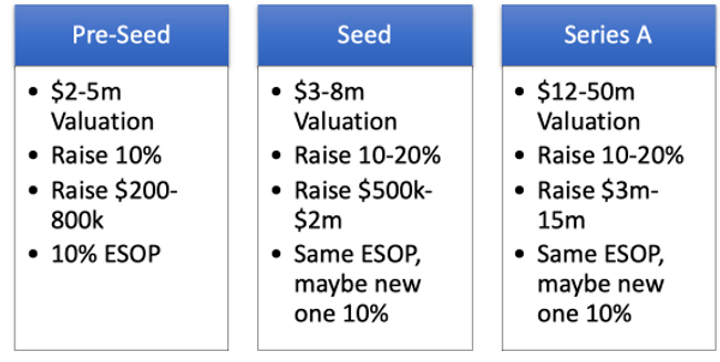

Be clear on the growth milestones to be achieved and the capital you will need to raise over this period. From his experience and research, investors will typically assume a 10-20% dilution on the amount raised as shown below:

Where the round lands within the 10-20% dilution range depend on several factors, such as securing a supportive lead investor, competitive tension in the round and growth expectations (10% pa for early-stage ventures and 50-70% pa for later-stage ventures).

Remember that it's rarely just about 1 round. Therefore, setting reasonable expectations while managing the dilution over multiple raises should be the goal rather than maximising the valuation.