Customer Centricity – Pricing Power

And the Potential from Serving Your Most Valuable Customers

In these uncertain times, how can customer centricity benefit founders? The answer - pricing power. Increasing prices does more for profitability than acquiring customers.

Yet many businesses underestimate what they can charge because they don’t understand their customers. Under-pricing reduces growth and the product’s customer appeal. Exactly what you want to avoid!

Being customer centric results in better products that customers will pay more for. This article explores how customer centricity can unlock a startup’s pricing power. This relationship is also true for larger companies like Spotify*. Serving its most valuable customers is the key to improving Spotify’s profitability.

Customer centricity is an important part of a business’s competitive advantage. It has been the key to some of my most successful investments. This is a topic that I am always passionate to learn more about.

*This is not financial advice

Table of Contents

Pricing Strategy - Don't Leave Money on the Table

Value Based Pricing - Customer Centricity Equals Pricing Power

The Pricing Model - Packaging Matters

Spotify's Customer Centricity and Potential Pricing Power

Conclusion

Pricing Strategy – Don’t Leave Money on the Table

Pricing is one of the biggest levers for a business’s profitability. A Fortune 500 study found that a 5% increase in pricing increases operating profit by 22%. Pricing has an even greater impact on subscription-based companies due to its recurring nature. Improving pricing grows profitability by 4x more than customer acquisition and 2x more than retention.

Yet other areas like customer acquisition get the lion’s share of management attention. Some common reasons are:

Customers: Raising prices can be scary for founders. How will customers react? There is a perception that pricing is a zero-sum game. Value gained by the business is value lost by the customer.

Competition: The belief that the market sets pricing, and our focus should be on selling product and managing costs.

Organisational Structure: Pricing involves many areas such as sales, marketing, and product. As a result, there is no natural ‘owner’ of pricing.

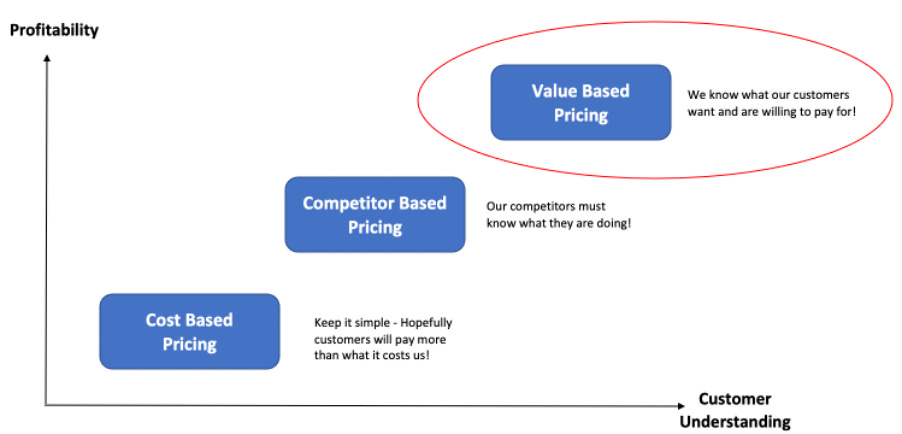

Therefore, pricing in many businesses lack direction. Product pricing is based on:

What it costs to produce: Applying a standard margin on top of product development, marketing and other costs.

What competitors are charging: Using competitor pricing as a guide to what the customer is willing to pay.

As a result, many startups leave money on the table. Pricing should be based on the value the product creates not its costs. Also, a startup needs to be delivering better value than existing solutions anyway. Its pricing should reflect this.

Why is under-pricing a problem? Growth and positioning.

Under-pricing results in less resources to reinvest. Areas such as product development, marketing, retention will suffer. This will result in lower growth.

It is also a lost opportunity to understand what customers value about your product. Over time, this could impact the product’s market positioning. Consumers will see it as a low-cost offering and lose interest. Exactly what you were trying to avoid!

Ultimately, a business should aim to price according to the value it provides. Doing so requires a strong understanding of its customers.

Value Based Pricing – Customer Centricity Equals Pricing Power

Value based pricing sounds like a great solution. However, it requires time, research and deliberate choices. These choices need to be based on customer needs and what they are willing to pay. This is why value based pricing is often called customer based pricing.

Subscription pricing intelligence firm ProfitWell recommends the following broad steps:

Targeted Customer Segments: Learn about and identify your highest value customers. E.g. what industries they are in, typical company size, role within the company etc. This will be the segment to target.

Customer Empathy: Understand the preferences (e.g. most valued features) and willingness to pay in the targeted customer segment. This involves customer surveys and marketing studies. The goal is to build a differentiated product that provides superior customer value.

Beyond the First Transaction: Going beyond getting a sale. What is the cost to acquire the customer? How can we provide a great experience that can retain our customers and generate referrals? These are key inputs into the common ratio Lifetime Value/Customer Acquisition Costs.

Do these steps sound familiar? They are also the principles for customer centricity! Being customer centric results in better products that customers will pay more for. This is the link between customer centricity and pricing power.

A caveat is that value based pricing works best when competition is rational. Customers won’t pay more if competitors keep charging rock bottom prices. Picking the right industry matters!

The Pricing Model – Packaging Matters

This is where it all comes together. A pricing model describes how the customer will be charged. Examples of pricing models include charging based on features, flat rates, tiered etc.

A lot goes into designing this. I believe the most important piece is to align the value the customer gets with what she/he is paying.

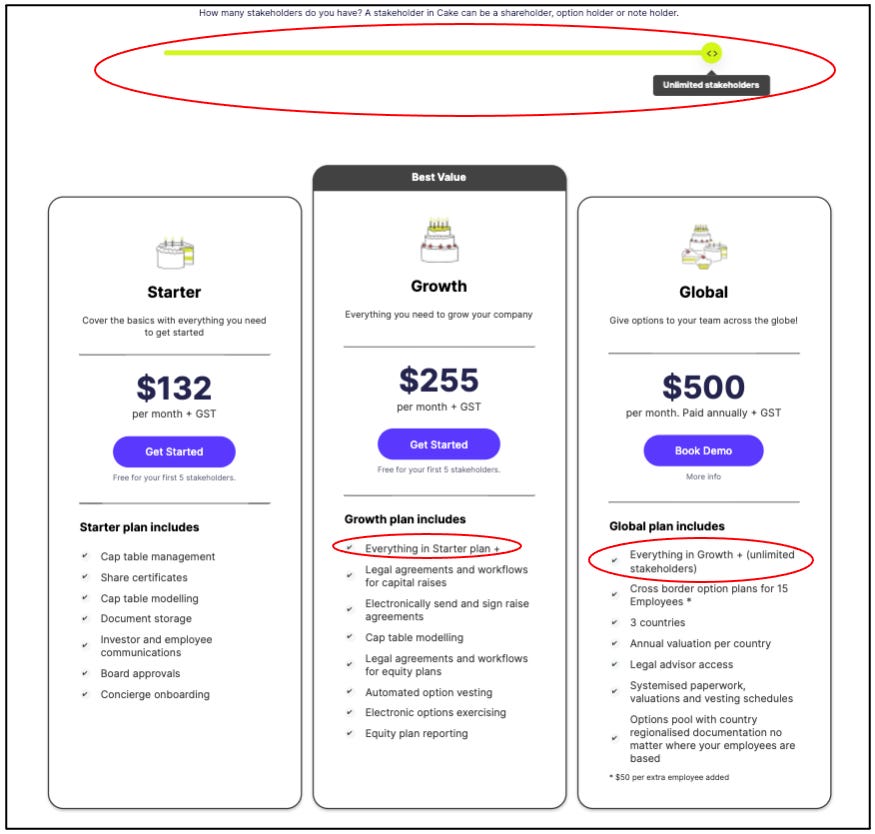

Cake Equity is an example of a business with a well-designed pricing model. Cake Equity provides administrative software that helps pre-seed to series B startups manage their equity. The software simplifies the issuing and transferring of shares, options and notes.

I enjoyed my conversations with founders Jason and Kim who really understood their customers. Their pricing model has well-defined tiers and is simple to understand.

Well-Defined Tiered Pricing

There are 3 pricing packages organised around:

Number of stakeholders: The software provides more value as the number of stakeholders increase. For example, more shareholders or employee option plans require more administrative work.

Feature Tiers: Clearly defined feature tiers according to specific customer segments. The Starter Tier is for earlier stage customers requiring standard administrative software. The Growth Tier is for growing companies that needs employee share plans or options. The Global Tier is for companies operating in multiple geographies.

Overall, there is a clear relationship between the price customers pay and the value they get from the software.

Simplicity

Cake Equity's pricing is easy to understand. Starter and Growth customers can sign up themselves. Global customers have clearly defined next steps.

We talked about the ability to improve a startup’s pricing power by being customer centric. I believe this is also true for larger companies like Spotify.

Spotify’s Customer Centricity and Potential Pricing Power

Who hasn’t heard of Spotify? It pioneered digital audio streaming as we know it today. Spotify dominates the global streaming market with double the market share of its nearest competitor Apple.

It’s easy to understand the value Spotify brings. I could live without my Netflix subscription, but I use Spotify throughout the day and will struggle without it.

Yet, you couldn’t tell by their pricing model.

The pricing model charges subscribers a flat rate which does not scale with the value that Spotify provides. Given its industry leadership position, why is Spotify leaving so much money on the table? The reason - its record label content suppliers.

Spotify sources most of its content from record labels. Three record labels dominate this industry. The record labels:

Limit profitability by taking the bulk of the income from streaming.

Limit differentiation by not allowing exclusive content. Having identical music libraries makes it hard for streaming providers to charge a premium.

However, Spotify’s greatest asset is the understanding it’s built around its 400 million users.

The music industry is characterised by the True Fan or Super Fan. These are fans who will buy anything that the artist puts out, such as vinyl records, concert tickets etc.

True Fans are the holy grail in creator economy areas like gaming where the top 1-2% of fans drive 80% of revenue. You can read more about True Fans and the music industry in my previous article here.

This is even more relevant for music artists as they must give up large portions of their streaming income to record labels. The key is finding and engaging these True Fans.

What if Spotify had a way to:

help artists find their True Fans and

facilitate these fan’s non-streaming purchases?

This is becoming a reality.

In terms of finding True Fans, Spotify knows more about you than you think. Here are some ways Spotify profiles its subscribers and helps them find songs/artists that they like:

Taste Profiling: Spotify builds a taste profile on each subscriber based on their listening activity. This profile is used to create Playlists of songs. Playlists are an important way for subscribers to discover new artists.

Playlist Profiling: Using Google-like Natural Language Processing algorithms to guess a subscriber’s tastes from the descriptions of songs in her/his Playlist

Audio Models: Using AI/neural networks to break down songs into characteristics (e.g. tempo). This gives further insight into a subscriber’s music taste.

With this customer insight, Spotify is well positioned to connect artists to their True Fans. There is already a feature called ‘Today’s Top Fan’ which shows you your most played artist.

I’m slightly embarrassed to know that my top artist is The Weekend (why am I so mainstream?). Note how Spotify can rank me as the top 52% of the artist’s fans.

Spotify is also building features which will allow these True Fans to make non-streaming purchases. Examples include:

Spotify Live: Live audio rooms where artists can connect directly with fans. Eventually, this could be a space to sell merchandise, concert tickets etc

Spotify Fan Support: Allows fans to tip their artists. This feature was made popular by video game streaming platform Twitch.

At their recent Investor Day, Spotify spoke of several ways it could improve its average revenue per user (ARPU). I believe the ability to connect True Fans directly with artists is the most interesting component of their ARPU growth due to:

The importance of the True Fan in the music industry. Spotify executive Alex Norström believes this ‘uncaps ARPU’.

Loosening the grip of the major record labels. I believe this is the biggest issue for the industry and Spotify’s profitability.

Changing their pricing model is a great opportunity for Spotify. On an earnings call, CEO Daniel Ek spoke about his intention to move away from their current flat pricing model. He also talked about the Super Fan opportunity on an earnings call.

‘I think the evolution here will be about unlocking through Super Fans. That’s where the real dollars comes in.’ Spotify CEO Daniel Ek

Conclusion

This article is about pricing power. In these uncertain times, pricing can be a business’s most important growth driver.

However, fearing the impact on customers, many businesses leave money on the table. This underpricing actually hurts customers in the long run.

This article shows how customer centricity allows businesses to create products which customers are willing to pay more for. This is the link between customer centricity and pricing power.

This link occurs in startups as well as larger companies. Spotify provides a vivid example of customer centricity which will enable it to:

Materially lift average revenue per customer by targeting its most valuable customers.

Lift profitability by improving its industry position.

Look out for more case studies on startups and their pricing strategies!