Exploring Crypto – Stable Coins, UST/LUNA and Minke’s Mission

Recently, a major stable coin called UST collapsed. UST’s demise erased nearly $40 billion in value and shocked the world of decentralised finance (defi). This article will explore what stable coins are, how this collapse occurred and my personal takeaways for defi and Minke.

The collapse of a major stable coin has not been good for confidence in the space. However, defi's promise is its ability to bring financial inclusion to millions. This is the long-term goal that Minke and others are pursuing.

This is the fourth article in the series Exploring Crypto which will lead to a profile on Minke.

Index

What is a Stable Coin?

Fiat Stable Coins

Crypto Collateralised Stable Coins

Algorithmic Stable Coins

TerraUSD - A Simple Explanation

Managing Supply and Demand

Growth Hacking Demand - The Anchor Protocol

What Went Wrong

Behind those Yields - A System Dependent on Growth

Breaking the Peg - A Vicious Cycle

Takeaways, Thoughts on Defi and Minke

What is a Stable Coin?

Participating in the crypto ecosystem requires holding cryptocurrency. Yet, it can be scary to keep one’s savings in a volatile currency like Ethereum. This is where stable coins come in.

Stable coins peg their value to a more traditional asset like the US dollar (USD). For example, 1 stable coin is equal to US$1. Their stability has made them a popular currency used in defi. Defi has been the driving force behind the nearly 400% growth in stable coins in 2021. Currently, stable coin market cap is around US$160 billion.

How ‘safe’ is this peg? Stable coins must consider 3 factors in their design:

Decentralisation- The degree to which the supply of stable coins is centralised. Centralised systems have a single entity managing supply. They are vulnerable to government actions like freezing accounts.

Responsiveness- The ability to maintain the peg in response to market demand.

Collateralisation- The capital required to secure the stable coin to the peg.

Stable coins must make trade-offs. The ‘trilemma’ is that stable coins can only optimise for 2 out of the 3 factors. This has led to 3 main types of stable coins.

Fiat Stable Coins

Popular examples are USDC (by Coinbase and Circle) and USDT or Tether (by iFinex). They are backed one-for-one by fiat currency reserves such as US dollars. These reserves are held in traditional banks.

Fiat stable coins are fully collateralised and can respond quickly to market demand. However, centralised entities are needed to run them. These centralised entities and bank accounts are subject to government intervention.

Crypto Collateralised Stable Coins

A popular example is DAI by Maker DAO. These stable coins are backed by cryptocurrency, which allows them to be decentralised. They make up for crypto's volatile nature by reserving more capital or overcollateralising. Being decentralised makes them less responsive to market demand.

Algorithmic Stable Coins

An example is TerraUSD or UST which will be discussed further. These stable coins are not backed by collateral or reserves. Instead, they rely mainly on rules or algorithms built into their smart contracts.

These systems have two tokens, a stable coin and a cryptocurrency acting as a capital reserve. The algorithms manage the demand and supply between these two tokens to maintain the peg.

Algorithmic stable coins are decentralised and responsive to market demand. However, their lack of collateral can cause them to collapse during times of stress, as we will see with UST.

TerraUSD – A Simple Explanation

This section will briefly describe TerraUSD, including how the algorithm manages the peg and how it has accelerated demand for UST.

Managing Demand and Supply

Terraform Labs was founded in 2018 by co-founders Do Kwon and Daniel Shin (Daniel later left the company). Terraform Labs created the Terra Blockchain. The two primary tokens on the Terra Blockchain are the stable coin UST and the cryptocurrency LUNA.

The Terra Blockchain manages the supply and demand between the two tokens to maintain the value of UST to US$1. It does this by allowing for the exchange of $1 worth of UST for $1 worth of LUNA.

Let's start with an example of excess supply and UST trading under the $1 peg. In this example, 1 UST is trading at $0.95 and 1 LUNA is trading at $10.

Step 1: Buy 1 UST on the open market for $0.95.

Step 2: Exchange this UST on the Terra Blockchain for $1 worth of LUNA. As LUNA is trading at $10, I will get 0.1 LUNA.

Step 3: Sell this LUNA on the open market for $1, making a profit of $0.05.

The Terra blockchain will

'Burn' the UST that I exchanged, reducing the UST supply and increasing its price towards the $1 peg.

'Mint' or create 0.1 LUNA, increasing the supply of LUNA.

Increasing the supply of LUNA could cause a drop in the LUNA price. Why would LUNA token holders want to be exposed to this risk? To understand this, let's look at an example of excess demand for UST.

In this example, UST is trading at $1.05 and 1 LUNA is trading at $10.

Step 1: Buy 0.1 LUNA on the open market for $1.

Step 2: Exchange this LUNA on the Terra Blockchain for 1 UST.

Step 3: Sell the UST on the open market for $1.05 and make a $0.05 profit.

The Terra Blockchain will

'Burn' the LUNA exchanged, thereby reducing the LUNA supply and pushing up its price.

'Mint' or create 1 UST. This increases the UST supply and pushes the price down towards the $1 peg.

This example illustrates how growing demand for UST can result in higher prices for LUNA. The expectation of higher prices drives investor demand for LUNA.

This highlights the interdependence of algorithmic stable coins like UST.

The ability of UST to maintain its peg is dependent on the value of LUNA, which acts as a capital reserve.

Unlike US dollar reserves, LUNA is a volatile cryptocurrency. Its value depends on the demand for UST.

In other words, the system's viability depends on the increasing adoption of UST.

Until recently, this seemed like a good bet. How did TerraUSD become the third-largest stable coin with an $18 billion market cap before the crash?

Growth Hacking Demand – The Anchor Protocol

UST needed a ‘growth hack’ to generate adoption and kickstart the flywheel effect. To do this, they built the Anchor Protocol on top of the Terra Blockchain. The Anchor Protocol is a lending and borrowing platform. The idea was to incentivise demand for UST by offering very high UST deposit rates or yields of nearly 20%.

The plan worked. UST's market capitalisation was $180 million in early 2021. By April 2022, this had grown 10x to circa $18 billion. Thanks to its generous yield, around 70% of this demand came from Anchor deposits.

This demand also increased the price of LUNA. At its peak in April 2022, LUNA was trading at nearly $120 and had a market cap of $41 billion. This is more than double the market capitalisation of UST.

As such, UST holders would have been reassured that the peg had plenty of support. What could go wrong?

What Went Wrong

Behind Those Yields - A System Dependent on Growth

How did the Anchor Protocol fund its industry leading deposit yields?

This was largely sourced from borrowers of UST in the form of

Interest payments on UST loans

Yields earned by the Anchor Protocol on the collateral contributed by borrowers

As such, the protocol needs to attract borrowers to fund the growth in demand for UST. Why were borrowers willing to pay the high interest rates on Anchor? Largely because they believed in the growth of the Terra ecosystem as:

LUNA Growth: Borrowers primarily provide LUNA as collateral in exchange for UST. The Anchor Protocol required at least twice the value borrowed in collateral. This only made sense if borrowers expected their LUNA to appreciate in price.

Anchor Protocol Growth: To attract borrowers, the Anchor Protocol rewards them with Anchor (ANC) tokens. They act as a significant subsidy to the borrowing costs. ANC tokens represent ownership in the protocol itself. As such, the value of this subsidy depends on the growth of the Anchor Protocol.

This was a system designed around increasing demand for UST as shown below:

The TerraUSD ecosystem which relied on the continued growth of UST demand.

In particular, it was becoming difficult to support the promised high deposit yields.

These high yields were thought of as a ‘marketing cost’. The idea was to accelerate the adoption of UST and make it widely accepted. For example, using UST in real world applications such as Terra’s merchant payment app Chai. At that point, the high yields and subsidies could be wound back to more sustainable levels.

In the meantime, capital reserves were being used to fund the income shortfall. The crypto market downturn in late 2021 decreased the income from borrowing. This widened the shortfall and drain on reserves.

In response, founder Do Kwon set up the LUNA Foundation Guard (LFG) in February 2022. The foundation’s focus was to support the UST peg and promote growth.

LFG raised $1 billion led by Jump Crypto and Three Arrows Capital. The proceeds would be used to build a capital reserve. This reserve would consist of external cryptocurrencies like Bitcoin.

These initiatives would prove too little, too late.

Breaking the Peg – A Vicious Cycle

Do Kwon had optimised the TerraUSD ecosystem for growth. However, this made it vulnerable in a crypto market downturn with nervous investors.

On Saturday 7th May, hundreds of millions of UST stable coins were sold. The impact of such large and sudden selling pressure on UST was to force it away from the $1 peg to nearly 90 cents.

This set off a vicious cycle as shown below:

A vicious cycle when demand for UST drops sharply.

The Terra Blockchain’s mechanism for exchanging $1 of UST for $1 of LUNA was meant to balance supply and demand. However, it was increasingly ineffective when the price of LUNA is sharply falling.

If UST was trading at $0.90, a trader could exchange this for $1 worth of LUNA on the Terra Blockchain. However, she/he could not make a profit selling LUNA on the open market if its price is falling by over 10%.

Further LUNA price falls uncovered another flaw in the Terra Blockchain's design. The exchange mechanism fixed the price of one side (UST) of the trade but not the other (LUNA). As the LUNA price fell, this mechanism became hyper inflationary.

For example, if LUNA is worth $10, a LUNA token is created when 10 UST tokens are exchanged through the blockchain. If the LUNA price drops to $1, the same exchange of 10 UST tokens will create 10 tokens of LUNA.

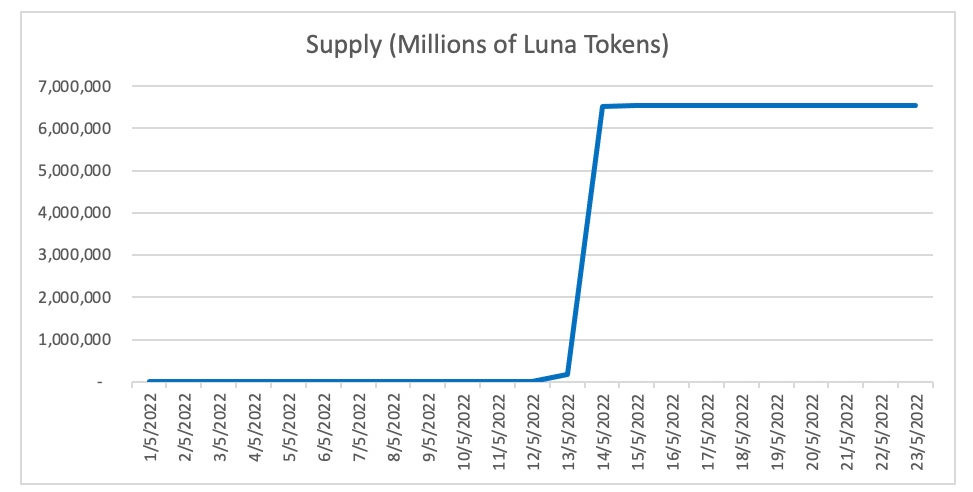

The supply of LUNA had been around 350-420 million tokens for most of the past 2 years. On the 12th of May, it exploded to nearly 1.5 billion from 380 million tokens the day before. As of writing this update, the supply stands at 6.5 trillion tokens making it nearly worthless.

The speed of the collapse of the 3rd largest stable coin was breathtaking. Investors only had a matter of days before losing most of their value. It is hard to see UST or LUNA recovering.

Takeaways, Thoughts on Defi and Minke

The post-mortem on this debacle is ongoing and will draw regulatory attention to stable coins. My personal takeaways are to:

Adopt a long-term, sustainable approach rather than chase short-term yields. Assets paying 20% yields come with risk and are rarely ‘stable’. Do your own research.

Only invest in what I can understand. Complexity is a red flag. Particularly where the smart contract algorithms can cause a collapse with brutal efficiency.

We are still early in defi and there will be more lessons to learn. However, it is important to recognise the potential impact of stable coins and defi. They could benefit millions struggling with devaluing currencies and access to financial services.

To this point, a Gemini study found that people in countries struggling with currency devaluation were 5x more likely to adopt cryptocurrency in the next 12 months. To me, this is the promise of defi.

Minke co-founder Josh Reyes described how family members in India faced this problem. Minke’s mission is to make the benefits of defi accessible to millions globally. This can be seen in Minke’s thoughtful design and emphasis on education.

You can read about Minke co-founder Josh’s thoughts on the UST crash here.