Google Search - Staying Ahead in the Age of AI

“ChatGPT has consumed an extraordinary percentage of the time and energy I used to spend in Search. So it’s kind of hard to believe that it’s not really having an impact on Search revenues. But it’s not.”

Brad Gerstner, Altimeter Capital Founder on the BG2 Pod

Brad made this quote while reflecting on Alphabet’s recent results, which continue to show strong growth in Search revenue. While Alphabet pioneered digital advertising two decades ago and has dominated the market with its ubiquitous Google Search product, generative AI was expected to pose one of its greatest challenges.

However, Alphabet’s Google Search is uniquely positioned to benefit from this shift rather than be disrupted by it. Not only has Alphabet held its ground—it is poised to pull ahead of newer AI competitors.

This article will discuss:

The key to making money in Search

How AI helps, not hurts Google Search’s ability to make money

How Google’s competitive advantages from its ubiquitous everyday applications and scale insulate it against LLM competitors

Let’s dive in.*

* All opinions are personal. This is not investment advice.

Making Money in Search Advertising - Driving Customer Intent

“I think that Meta and Google are actually amongst the best placed for this AI wave because all this investment goes directly to their core product, which is targeted ads.”

Ben Thompson, Stratechery Founder on the Sharpe Tech Podcast

In his writing, influential blogger Ben Thompson talks about AI’s ability to substantially increase advertising inventory.

In Google Search’s case, it’s about AI’s ability to increase commercialisable inventory - the inventory that can be monetised.

In simple terms, advertising monetisation occurs when the right advertisement is viewed by the right user. This requires the right balance between user experience (e.g. relevant content) and advertiser objectives (e.g. customers clicking through to their web page).

The Search business has 3 key drivers:

Inventory - Monetisable ad inventory depends on how many users you reach (audience reach), the content they're consuming (which influences engagement and opportunities for ads), and the proportion of ad spaces that are successfully filled with advertisements (ad-fill).

Click Through Rate - The percentage of users who click on the advertisement. The more engaged the user is with the content and the more targeted the advertisement, the higher the chances of a user clicking through to the advertiser.

Cost Per Click - Advertisers are willing to pay more for each click if it is more likely to lead to a conversion such as a purchase or a sign-up.

Therefore, Google Search’s revenue generation relies on its ability to understand and target user intent. High-quality content engages users, enabling precise targeting of their needs, which leads to higher conversion rates—the very results advertisers are paying for.

AI’s Potential to Build Intent

So here, our philosophy, as we've stated many times before, is we try to use ads that are actually -- or any display ads that are helpful to users… again, on 80% of our searches, we actually show no ads. And so most of the ads that you're actually seeing are on searches with some form of commercial intent…So the question you have to ask yourselves is, are we actually optimized on this?

Philipp Schindler, Google Senior Vice President and Chief Business Officer, UBS Global TMT Conference 2020.

At first glance, AI applications like ChatGPT are disruptive to Google’s Search business. Why bother with 10 blue links when you could go straight to the answer?

However, Philipp’s comments show that many of those blue links don’t generate advertising revenue anyway.

AI could potentially not just discover intent, but generate it as well.

Consider Google’s AI Overviews feature that is being incorporated into Google Search. AI Overviews is powered by Alphabet’s Gemini AI model and its multi-step reasoning capabilities. By doing more of the work for us, AI Overviews makes it easier for us to delve deeper into topics - it grows our intent

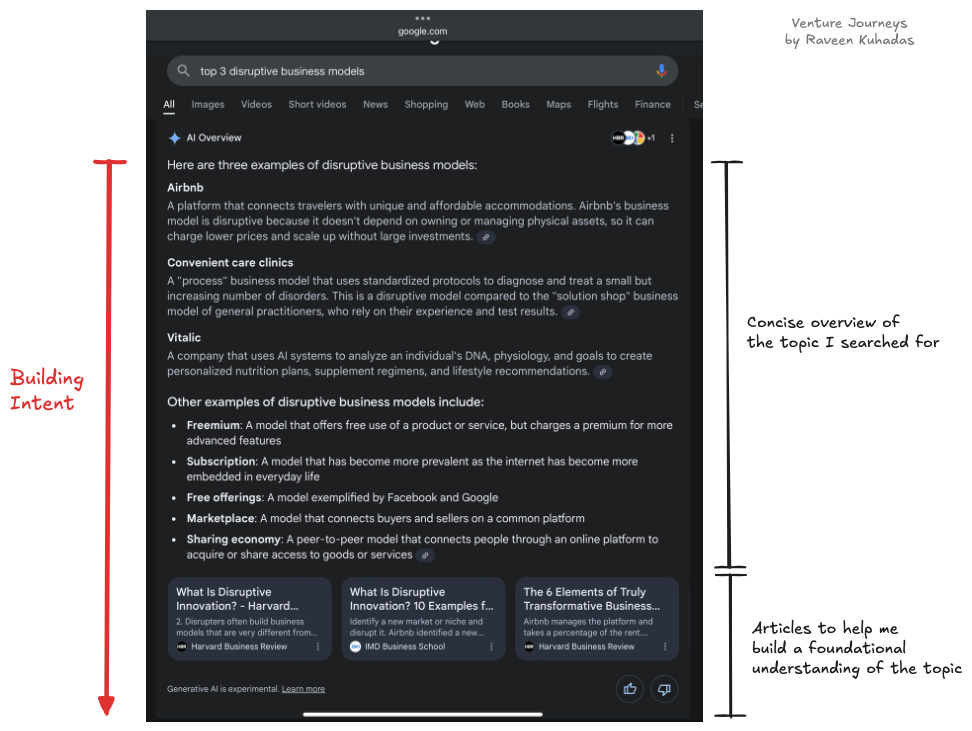

Take my search on disruptive business models as an example. This is a fairly broad search term on a complex topic. AI Overviews did a good job of:

Understanding my intent - AI Overviews worked out that I wanted to learn more about disruptive business models rather than a subjective ranking of the top 3.

Generating my Intent - Instead of a series of blue links to articles, AI Overviews gave me concise summaries that build my interest in the topic. The foundational articles at the bottom are linked to commercial intent. For example, subscribe to the Harvard Business Review or enroll in the IMD Business School.

“We are seeing strong engagement, which is increasing overall Search usage and user satisfaction. People are asking longer and more complex questions and exploring a wider range of websites … The integration of ads within AI Overviews is also performing well, helping people connect with businesses as they search”

Sudar Pichai, Alphabet CEO on the Company’s 3Q24 earnings call

An added benefit is that it keeps consumers on the same Google Search platform. This is an important point for an incumbent facing disruption from the likes of potential Large Language Model competitors like OpenAI.

ChatGpt’s impact on Google Search since its introduction in late 2022 has been limited. Revenues continue to grow and traffic acquisition costs remain stable.

However, the aspects of Google’s competitive advantages that competitors will struggle the most with are the sheer breadth of its online presence and the scale of its infrastructure.

Google Everywhere - It’s Not Just About Search

“Our global footprint (goes) beyond Search. We have 6 products with more than 2 billion monthly users, including 3 billion Android devices. 15 products have 0.5 billion users, and we operate across 100-plus countries. This gives us a lot of opportunities to bring helpful gen AI features and multimodal capabilities to people everywhere and improve their experiences.”

Sundar Pichai, Alphabet CEO on Alphabet’s 1Q24 Earnings Call.

Sundar’s comments highlight the ubiquitous nature of Google’s applications in our lives. I use the company’s products every day. Whether it’s Search for work, YouTube to learn a new skill (or to watch the NFL Highlights!) or Google Maps when I’m driving. Google Search’s ability to gauge my intent depends on my use of Alphabet’s various applications, and that I use them constantly.

All of my interactions across these applications feed into Google’s algorithms. Analysing data from my actions across applications (product-in-use data) creates a powerful data network effect - the more I use these services, the better they become at anticipating my needs, which not only improves my experience but also enhances the algorithms’ personalisation capability for other users.

However, my intent changes over time (people change!). To stay relevant, it’s important that the algorithms can capture data from my latest interactions.

This is why it is important to have a breadth of applications. These provide a broad surface area to frequently capture my interactions keeping the data Google has, fresh.

Google’s advantage is therefore more than any one application. As Sundar highlights, few companies have Google’s expansive range of ubiquitous online properties - and the infrastructure scale to power its algorithms.

Engineering and Hardware - The Power of Scale

“We would lose a fair amount of money on Gmail if we did our data centers and servers the conventional way. Because of our efficiency, we can make the cost small enough that we can give it away for free.”

Urs Hölzle, Google’s first VP of Engineering, on an interview for a Wired Article (October 2012)

Gmail was revolutionary when it launched in 2004 offering 1GB of free storage. This was a time when competitors like Hotmail (remember them?) had only been offering 2-4Mb. How did Google do this? Scale - Google’s willingness to commit significant capital investment into its hardware and data centres

“Our core advantage really was a massive computer network, more massive than probably anyone else's in the world”

Jim Reese, Former Google Chief Operations Engineer and early employee (October 2012).

It would have been less risky to rent the hardware and make smaller lease payments over time. However, by locking in the variable cost of these lease payments, Google would not enjoy economies of scale.

Committing to large capital expenditures creates upfront fixed costs. In exchange, as the Gmail example shows, Google stands to benefit from significant economies of scale- particularly if Google’s margins are high enough to recoup the cost of the equipment well before the end of its useful life. In 2023, Alphabet spent $32bn on capital expenditures, more than capital intensive companies like Intel ($26bn) or TSMC ($31bn). Yet this represented just over 10% of Alphabet’s revenues.

LLM competitors like OpenAI, typically lease their compute hardware from large cloud hyperscalers like Microsoft, Amazon’s AWS or Google Cloud.

For example, The Information estimated that as of March, OpenAI was on track to spend nearly $4 billion in 2024 on renting Microsoft’s servers. This was nearly 90% of OpenAI’s estimated annual revenue. As leasing payments are variable costs, average costs do not decline as these LLM competitors grow.

Importantly, the efficiencies from economies of scale allow Google to invest in customer acquisition. Acquiring customers, feeds into the network effects that its applications need to be successful. Google Search spends roughly 24% of revenue on customer acquisition. In 2023, this represented over $50bn. Customer acquisition spending will only grow as Google gets larger, locking in its advantage.

Conclusion

“What Google discovered in the past is that you need to have 100% of the queries if you want to make money on the 18%. So sure, you remember the queries you’ve done with Perplexity and OpenAI but these are the 24% that are not monetisable…the magic of Search is having this box where people just ask everything. And AI is going to have to live there.”

Jean-Paul Schmetz, Brave Software Chief of Advertising on This Week in Startups

Jean-Paul is the Chief of Advertising of Brave Software, a rival Search engine. Like many long term shareholders in Alphabet, I saw the introduction of AI LLMs as a disruptive threat to the lucrative Search business.

However, as Jean-Paul’s comments show, what matters is the roughly 20% of search queries that are monetisable. I.e. those that have commercial intent.

The promise of AI is its ability to grow the proportion of monetisable search queries by generating intent with Google’s users.

While researching the disruptive risk of LLMs, I was surprised at how Google’s dominance of Search is augmented by the breadth of its product offerings. Generating intent depends not only on the widespread adoption of Google’s products but also on frequent engagement with them. This underscores the importance of customer acquisition, as Google must both attract users and ensure their sustained interaction with its ecosystem.

To achieve this, Google’s scale enables substantial upfront capital investments, which will give its AI applications a cost advantage. This advantage can be reinvested to make its AI tools more affordable or to drive further customer acquisition, reinforcing its dominance.

As AI continues to evolve, Google’s competitive advantages from its ubiquitous everyday applications and scale, position it well against LLM competitors. If what Google did with Gmail’s online storage is anything to judge by, I’m excited for the affordable innovations to come.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.