Microsoft - Monetising AI Through Software Bundling and Copilot’s New Pricing Strategy

Will Microsoft’s AI investments pay off? Its revenue has not kept pace with the nearly 50% per year increase in capital expenditure since ChatGPT’s introduction in 2022. However, comments from CFO Amy Hood indicate this may be about to change.

“And while we expect to be AI capacity constrained in Q3, by the end of FY '25, we should be roughly in line with near-term demand given our significant capital investments. “ Amy Hood, Microsoft CFO, January 2025 Earnings Call

The source of Microsoft’s competitive advantage has long been its ability to bundle. Netscape and Slack famously struggled to compete when Microsoft could afford to include a competitive, “good enough” offering at minimal cost and drive rapid adoption across its enormous user base.

In early 2025, Microsoft announced a strategic shift in its Copilot pricing strategy. Thanks to its investments in capacity, Microsoft is able to expose (and charge) its entire Microsoft 365 user base to Copilot through its standard bundles for the first time. Copilot usage metrics will be a key metric for investors to monitor during subsequent earnings calls as it will be increasingly difficult to separately define AI revenue.

For investors, this pricing shift could signal a lucrative new phase of Microsoft’s AI strategy. Microsoft’s users will allocate an increasing portion of their software budget as they experience the benefits of Microsoft’s growing AI offerings. This includes replacing other SaaS applications that generative AI has the potential to disrupt.*

Read on to learn about:

How Microsoft’s capital intensity makes it a cost leader

Understanding Microsoft’s strength in software bundling

Copilot’s pricing change and how it unlocks the power of Microsoft’s user base

* All opinions are personal. This is not investment advice.

Building AI Capacity - Microsoft’s Capital Intensity and Cost Leadership

For years, Microsoft and a generation of subscription-based, Software as a Service (SaaS) companies, have benefited from high levels of revenue growth and returns on capital.

However, ChatGPT’s introduction in 2022 has launched a wave of capital investment as SaaS companies raced to stay ahead by building generative AI driven capabilities into their products.

As such, Microsoft has significantly increased its capital expenditure, growing at an average rate of nearly 50% per year. However, as shown in the chart below, revenue growth has not kept pace. In FY22, capital expenditures represented 12% of revenue, but by FY25 , this ratio is projected to rise to 29%, reaching $80 billion. Investors are understandably concerned with Microsoft’s ability to generate demand and earn a return on this investment.

The truth is, capital intensity is an important feature of Microsoft’s business model. In FY24, it had $136bn of fixed assets, greater than the circa $100bn of fixed assets that capital intensive companies like TSMC and Intel have. These fixed assets are an important part of Microsoft’s cost advantage, making it significantly more efficient than its SaaS peers.

For example, Microsoft is able to spread its infrastructure costs across a larger user base by ‘renting’ it out to other software companies like Adobe. In contrast, many software companies avoid such heavy capital expenditures. They invest instead in areas like customer acquisition, which have a more immediate impact on revenue or a faster payback. This allows these companies to grow quickly but it comes at a cost.

The rule of 40 is a popular metric used to analyse the efficiency of software companies. It is calculated by adding a company’s revenue growth and profit (EBITDA) margin. This metric prevents overemphasis on either growth or profitability, as software businesses may choose to prioritise one over the other.

As seen in the table and chart below, Microsoft’s 49.2% average EBITDA margin and 11.4% per year revenue growth give a score of over 60%, considerably higher than its peers. It is a cost leader.

The benefits of Microsoft’s increased capital investments are now emerging. The surge in AI demand caught many companies, including Microsoft, off guard. To meet this demand, Microsoft invested not only in AI specific hardware, such as NVIDIA chips, but also in foundational infrastructure, including data centers worldwide. These long-term assets require years to develop but are now becoming operational.

“What you've seen in that spend over the past few years … it is more long-term assets … I feel good that we've got enough of the long assets coming online. And so you'll see it pivot to be a little bit more weighted servers, CPUs, GPUs, other short-lived assets. And that's more correlated to revenue growth” Amy Hood, Microsoft CFO - Morgan Stanley TMT Conference, March 2025

The ‘pivot’ that Amy talks about should serve as a warning to other software companies. With its computing infrastructure in place, Microsoft has the capacity to offer its AI offering to its enormous user base through disruptive software bundling.

Understanding Bundling - The Source of Microsoft’s Competitive Advantage in AI

Microsoft is famous for its ability to disrupt its competitors with its software bundles. A well known example is the collaborative enterprise messaging platform, Microsoft Teams. Microsoft simply bundled Teams with its other products like Microsoft 365.

It rapidly outpaced industry pioneer Slack, despite being introduced 3 years later in 2016. This dominance continued even after Microsoft unbundled Teams from its Microsoft 365 and Office productivity offerings. What makes this strategy so devastatingly effective for Microsoft?

A great illustration of Microsoft Team’s adoption. Source: BEMO

Bundling has always been a powerful competitive strategy in more traditional industries. A well known example is Disney’s cable television bundle. Disney forced cable companies to take up its entertainment channels with its ‘must-have’ ESPN sports offering. This squeezed out other independent channels from cable television bundles.

However, this strategy is especially powerful in the software industry. This is due to a defining feature of software - low marginal costs. Once developed, it costs very little to produce additional copies of software. As outlined in Shapiro and Varian’s 1998 paper Information Rules:

“Information delivered over a network in digital form exhibits the first-copy problem in an extreme way: once the first copy of the information has been produced, additional copies cost essentially nothing. “ Information Rules, Carl Shapiro and Hai Varan, 1998

This low cost of replication means companies can drastically lower prices to gain market share, leading to intense price competition. This is why software is such a competitive business.

Bundling turns this feature into a strength. The idea behind it is simple - by combining multiple products, companies can increase what customers are willing to pay and earn more than they would selling items separately. This happens because people’s preferences for the bundle even out, even if they value each part differently—a popular concept in statistics called the Law of Large Numbers (the mathematical proof can be found here).

To understand this intuitively, imagine a fast-food combo meal: some love the fries, others the drink, but the single price attracts a wider audience. Sellers benefit by selling more bundles, and customers get a better deal than buying each item alone.

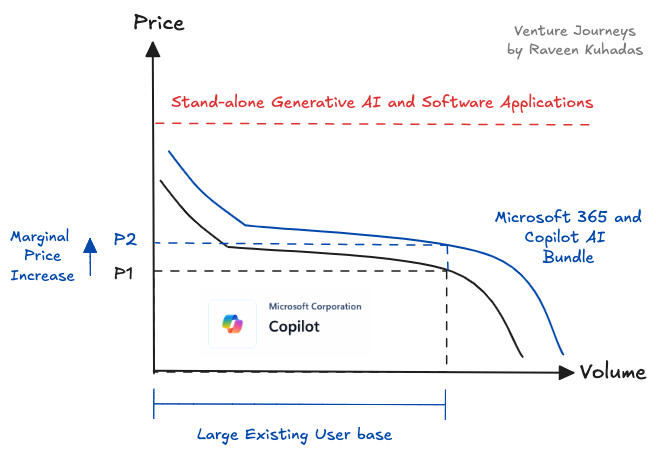

The result is a ‘flatter’ demand curve around a common average price for the bundle. The flatter ‘Bundle Demand Curve’ (in green) reveals how a small price increase—from P1 to P2—still reaches a large user base, unlike the steeper ‘Single Product Demand Curve.’

For example, if a competitor charges $10 for one item, a bundle seller with 10 loyal customers could add an extra product for ‘free’ and raise the bundle price by just $1, keeping buyers happy while covering costs.

The above chart has 2 implications for Microsoft. Firstly, its cost leadership allows a smaller shift in price for the larger bundle (smaller increase in P1 to P2).

The second implication is that it is existing users who will largely generate the return on Microsoft’s investment in AI. The larger the existing user base, the more disruptive the bundle.

Microsoft’s user base dominates the enterprise market. For example, in FY24, Microsoft had cloud revenue of $137bn, over 3x as much as Google Cloud’s $43bn.

As we will see in the next section, for the first time, Microsoft’s new Copilot pricing strategy will harness the power of this user base.

The New Copilot Pricing Strategy - Unlocking the Power of Microsoft’s User Base

Microsoft CFO Amy Hood’s comments regarding capacity, referenced earlier, have unlocked a strategic shift in Microsoft’s ability to use disruptive bundled pricing and earn a return on its AI investments. After over two years of increasing capital investments in AI, Microsoft now has the capacity to offer Copilot’s capabilities to its entire Microsoft 365 user base, rather than a small segment of early adopters. We can see this in the increasingly aggressive pricing strategies that were recently announced in early 2025:

Consumer Bundle - Microsoft announced the inclusion of Copilot into the Microsoft 365 Consumer bundle. Over 80m subscribers will get access to Microsoft’s AI offering, in exchange for a price rise of over 40% or $3 per month. Users will get access to a limited amount of monthly Copilot credits that “should be enough for most subscribers”.

Commercial Bundle - Microsoft announced the inclusion of Copilot Chat into its standard Microsoft Commercial 365 bundle. This is a much larger (over 400m subscribers) and more lucrative user base Copilot Chat provides ChatGPT-like features such as file uploads and the ability to create agents that can utilise organisational data. Users pay for each message sent (i.e. usage based pricing) through the chat, which makes Copilot more accessible than a separate $30 per user add-on licence.

As Microsoft CFO Amy Hood describes, Microsoft’s pricing is designed to get its large existing base of users to incorporate Copilot’s capabilities into their usual work habits.

“It is incredibly important to have 400 million-plus commercial M365 users, be able to learn the productivity that's possible just through Copilot Chat and watching that habit form and usage increase.” Amy Hood, Microsoft CFO, Morgan Stanley TMT Conference, March 2025

If Microsoft is successful in this, it will capture an increasing portion of software budgets as its users will be willing to pay more as they experience the value of Microsoft’s growing AI offering. This includes displacing other software applications that generative AI has the potential to disrupt.

For example, the $3 price increase for Microsoft’s Consumer bundle will also include Microsoft Designer, an AI-powered graphic design application and potential Canva competitor. Canva charges circa US$13 per month per user for its Pro offering.

As shown in the chart below, it will be increasingly difficult for other stand-alone software applications to find users who are willing to pay for their premium software and generative AI offerings - if Microsoft’s users can access most of this functionality though Copilot for only a marginal price increase.

Microsoft’s Copilot pricing changes now target a significantly larger part of its user base. Investors will need to monitor Copilot usage metrics as it will be increasingly difficult to separately define AI revenue from the revenue of the entire business. However, this pricing shift represents a potentially lucrative new phase of Microsoft’s AI strategy.

Conclusion

Software bundling has long been a competitive strength of Microsoft. It allows the company to adapt to technological changes by introducing new products and rapidly driving adoption through its large user base.

However, capital intensity and cost leadership are features of Microsoft’s success with this model. Since ChatGPT’s introduction in 2022, Microsoft had to invest upfront in AI capacity. Capital expenditure has grown at nearly 50% per year since then, but revenue has not kept pace.

Microsoft’s strategic shift in Copilot pricing signals an important pivot in its AI journey. Thanks to its investments in capacity, Microsoft is able to incorporate Copilot into its standard Microsoft 365 bundles for the first time. This could be a lucrative new phase for investors and a warning to other SaaS companies as Microsoft’s users experience the benefits of Copilot’s growing AI capabilities.

As AI is more seamlessly incorporated (and charged for) into Microsoft’s products, I believe Copilot usage metrics will be a key success indicator for investors to monitor during subsequent earnings calls.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.