Upcover

Gig Economy Insurance Cover Built from the Ground Up

Upcover provides pay-as-you-go insurance coverage tailored to workers in the fast-growing gig economy.

The founders pursued a unique customer-centric and grass-roots approach to product development and distribution. Grass-roots appeal will be an important asset to reach the broad gig economy contractor base as they add more delivery platform partnerships.

The founding team has domain and operational expertise. Their ability to attract highly experienced technical talent speaks to the potential of the idea.

Upcover has secured an insurance partner as well as partnerships with delivery platforms such as Uber. They have recently released their first product to market (food delivery bicycle driver).

The gig economy is one of the biggest trends impacting the workforce. Digital platforms and mobile devices, such as Uber, have enabled this by matching supply and demand in real time.

Greater freedom, flexibility, and employment options are some of the benefits to employees.

However, there are also trade-offs, including sick leave and paid time off, that full-time employees enjoy. This highlights the transactional nature of the relationship between these platforms and the gig economy workers. The lack of security is a real issue for these gig economy workers who rely on this income source.

Taking insurance to offset some of this uncertainty can be a complicated and expensive task for these workers. According to KPMG, traditional insurance providers face challenges such as policy pricing and legacy systems, which are poorly suited to developing products for the flexible nature of the gig economy's work.

This is where Upcover comes in. Upcover provides a pay-as-you-go insurance cover tailored to workers in the gig economy. It was founded in June 2019 by Skye Theodorou and Anish Sinha. Skye and Anish met during an Antler Accelerator Program, where they benefited from the program's mentorship and structure.

Skye has domain expertise from a 6 year background in insurance, including underwriting and project management experience at Zurich Financial Services. Co-founder Anish has a financial and operational background, including 3 years at Goldman Sachs and scaling a rapidly growing startup.

Their unique approach was to approach this problem from a very customer-centric perspective. Specifically, the founders conducted 2500 interviews with food delivery drivers. This approach

Gives them an in-depth understanding of these gig economy workers, which will inform product design such as key features, policy wording, and risk pricing.

Provides potential insurance partners with an incentive to underwrite this new form of insurance cover as Upcover can show evidence of a potential customer base. Upcover's insurance cover is provided by Agile Underwriting Services, backed by Lloyd's of London.

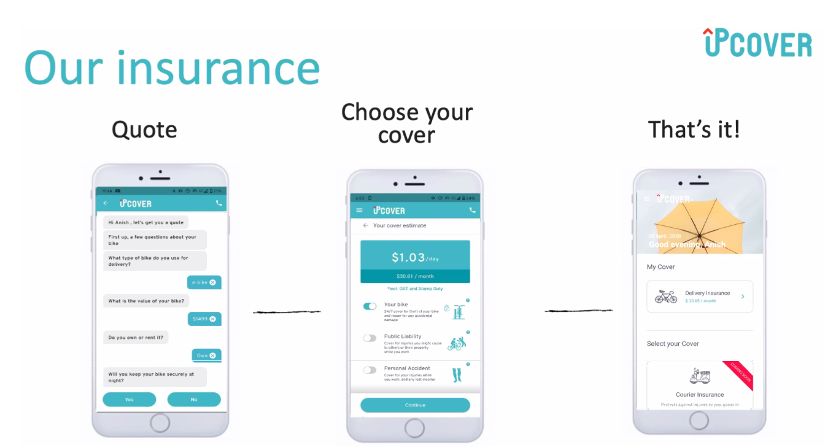

Based on customer feedback, Upcover has designed a mobile-enabled, simple-to-understand insurance product. The driver simply pays a low fixed monthly premium.

Importantly, Upcover's insurance cover is complementary to that already being offered by the food delivery platforms. Filling in the insurance coverage gaps from these platforms creates a more comprehensive level of coverage designed to give employees a sense of security rather than merely preventing liability to the platforms. This complimentary coverage positions them well to partner with the food delivery platforms for Upcover's distribution, a very scalable distribution channel.

Upcover has partnered with the Black Nova Group in the development of its technology platform. However, they have recently built out their technology and engineering team with a CTO (Sajjad Naveed) and a Principal Engineer (Joe Nalewabau). Sajjad has 10 years of experience in startup and technology firms. Joe has over 20 years of experience, including over 14 years at Microsoft. I think their ability to attract this kind of technical talent reflects the potential of their idea.

Upcover currently has a food delivery insurance product in the market but aims to cover 250 occupations in time. Their distribution strategy initially started with a grass-roots approach using community managers who had relationships with the delivery workers. However, it is evolving to include B2B platforms, including Uber, Sydney Bike Rentals, and Easi.

The founders see a $2bn addressable market in Australia. Interestingly, they see Australia as a test market and have global ambitions where the addressable market size is $20bn.

They are just over a year old and just launched their first product. However, I like the founder's customer-centric, grass-roots approach to product development. This grass-roots appeal will help them with the key challenge of marketing their product to a broad gig economy contractor base.