American Express: The 175 Year Old Tech Stock

American Express is an enigma. At over 175 years old, it is a company founded in the industrial age. Yet it bears a surprising resemblance to modern technology companies, with profitability in line with stalwarts like Microsoft. Its pricing model is a blend of upfront subscription and usage based pricing, which I believe will become highly topical in an AI world.

Success invites competition. Faced with an aggressive push by JP Morgan into the premium credit card market via its Chase Sapphire Reserve cards, American Express was forced to respond with more generous customer incentives and risky revenue streams.

However, aggressive competition can’t last forever. At some point, the aggressor has either won the market or is forced to concede leadership to the incumbent. The recent refresh of JP Morgan’s flagship Sapphire Reserve card represents a potential inflection in the industry. JP Morgan is now prioritising profitability, instead of aggressive customer acquisition. American Express will be a key beneficiary in this shift.

The recent industry pricing shift illustrates an investment opportunity for investors as well as a case study to evaluate emerging technology and SaaS models in the age of AI. Read on to learn about*:

The business model of premium reward cards

American Express’s technology-like subscription and usage based pricing model

Withstanding competition and American Express’s competitive advantage

Key takeaways for competing in an AI world

*All opinions are personal. This is not investment advice.

Card Reward Programs - Monetising the Premium Consumer

American Express needs no introduction. Think glamorous holidays funded by rewards points and generous rewards - in exchange for a hefty membership fee. However, as CEO Stephen Squeri highlights, that’s only half the story.

“We give access to great experiences through travel, through dining, through other events… when you’re charging a fee like that you tend to engage with more creditworthy, high-income premium consumers. And our partners love high credit premium, high-spending consumers… we will make their products and services available to people that will spend more money with them”, Stephen Squeri, American Express CEO at the Goldman Sachs December 2024 U.S. Financial Services Conference.

American Express’s affluent cardholders make it a potent customer acquisition channel to its partners. Expensive categories such as hotels and flights have price sensitive customers. Additionally, these suppliers typically operate the assets for the entire year, whether there are customers or not. For example, a hotel room left unsold this evening is simply revenue lost forever. These suppliers will fund generous upfront benefits and sell their products at discounted wholesale rates, if they believe American Express can deliver paying customers.

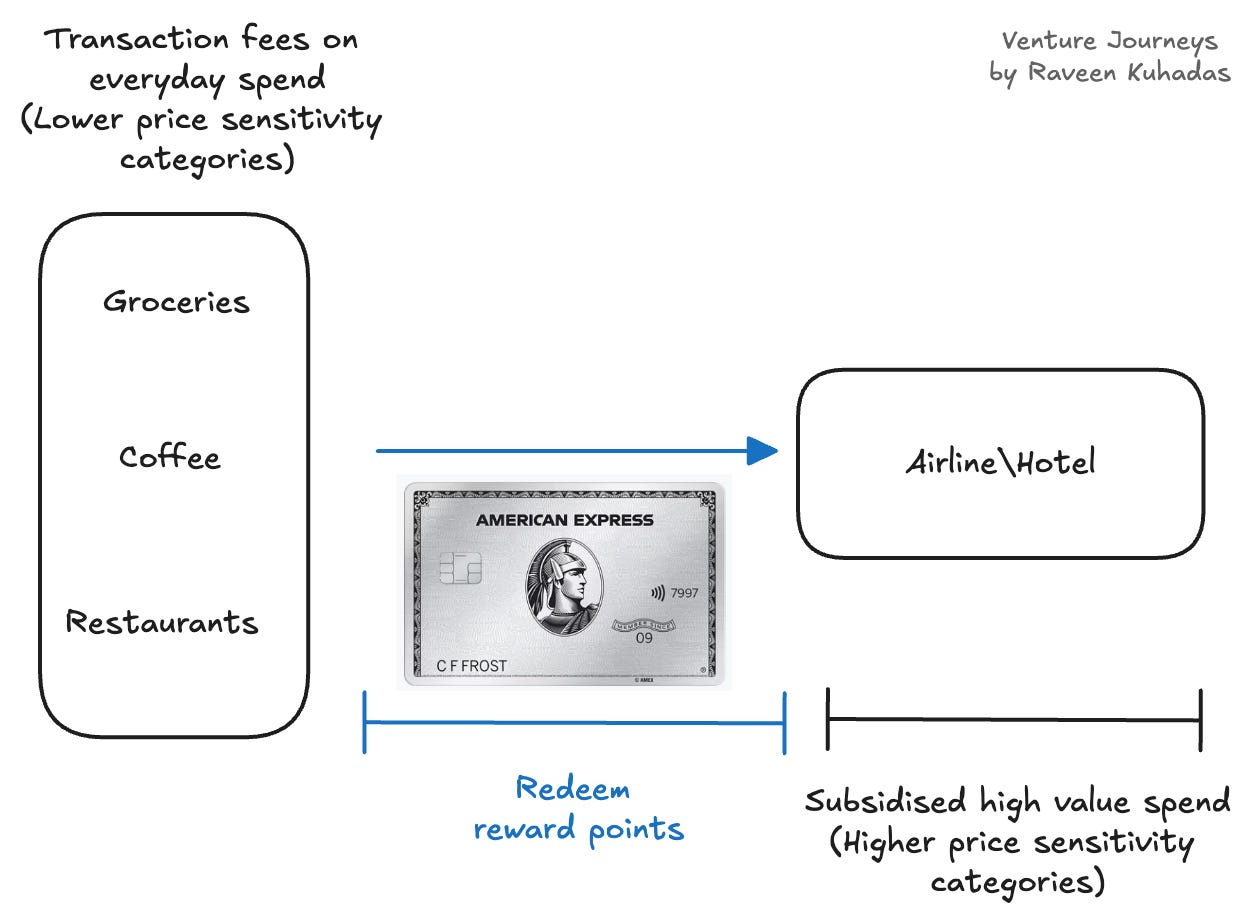

To incentivise cardholder purchases, credit card reward programs allow expensive categories to be subsidised by spending on everyday items, such as groceries, where the customer is less price sensitive as shown in the chart below.

Credit card reward programs subsidise expensive, price sensitive categories with frequent purchases on everyday items such as groceries

American Express earns the “spread” or arbitrage between the discounted costs of these services and the revenue American Express earns on upfront membership and usage transaction fees. It’s surprising how profitable this model has been, with many similarities to technology companies.

Hybrid Economics: The Tech-style Pricing Model

“You’re looking at a company that at the S&P 500 is in the top quartile from a revenue perspective and an EPS perspective. If you’re interested in a company with high revenue growth, mid-teens EPS growth, high ROE, good credit profile, global premium customer base and a great brand and a unique business model, you may want to consider investing in us”, Stephen Squeri, American Express CEO at the December 2025 Goldman Sachs U.S. Financial Services Conference.

Stephen’s statement above reads like that of a technology company CEO. American Express boasts profitability in line with Microsoft, with a return on equity of above 30%. Its pricing model combines the upfront certainty of subscriptions often seen in software companies like Microsoft and the scale of digital advertising based models famously used by companies such as Alphabet’s Google.

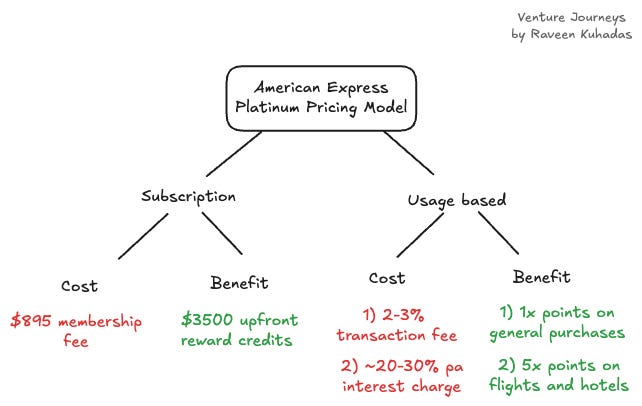

American Express’s hybrid subscription and usage based pricing model

The chart above broadly summarises the costs and benefits (rewards) for a Platinum card into subscription and usage based costs (the full list can be found here).

Card members pay an upfront annual subscription fee of $895 for the high-end Platinum card. This cost is offset by generous upfront reward credits, such as hotel benefits valued at up to $600 when booked at hotels affiliated with American Express’s reward program. Additionally, American Express receives a 2-3% transaction fee every time members use their card and is its largest revenue component. This is a form of usage based pricing.

However, this pricing model also has many of the benefits of an advertising model, given merchants contribute to transaction fees and reward credits. This adds significant scale. American Express is earning a commission (and receiving subsidised wholesale rates from advertisers) based on over $1 trillion dollars in completed transactions, significantly more than cardholders would be willing to pay themselves.

As we will see, such a lucrative model often attracts competition.

American Express’s Competitive Playbook: Subsidising Growth with High Margin Customers

“It’s been a war in that segment since Gordon Smith left American Express… when he first launched Sapphire… I think it helped us up our game a little bit… but there are a lot of people out there that want these premium cards, and we punch way above our weight”, Stephen Squeri, American Express CEO at the Bernstein 41st Annual Strategic Decisions Conference in May 2025

As Stephen Squeri highlights, competition in the premium card reward space has been intense since Gordon Smith (himself an American Express senior executive) defected to lead JP Morgan Chase’s credit card program in 2007. By 2019, JP Morgan was the top US issuer by purchase volume according to Nilson. It remains the top issuer in 2024 at circa $1.3 trillion. It was followed closely, in a two horse race, by American Express at circa $1.2 trillion. Citigroup was a distant third at $0.6 trillion.

American Express was forced to give customers a better deal by increasing the rewards. In a precursor to what many technology companies will face in the world of AI, this is akin to an increase in the cost of doing business in what was previously a high margin category.

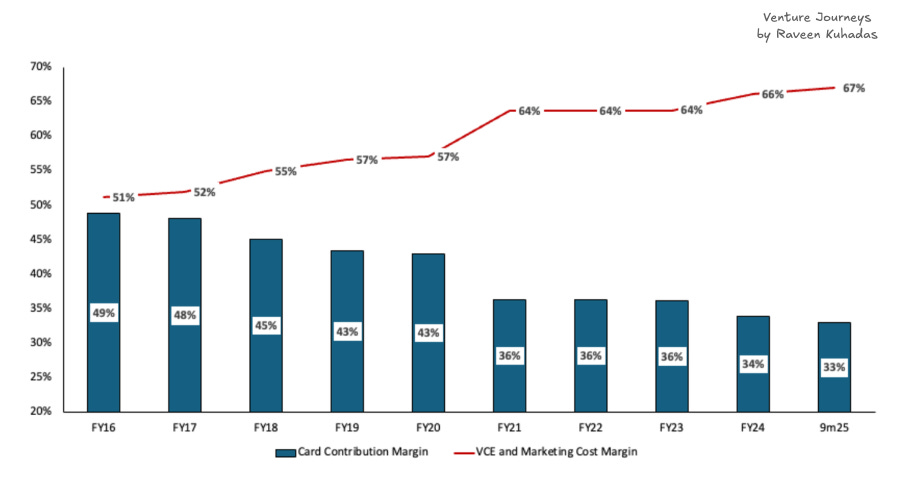

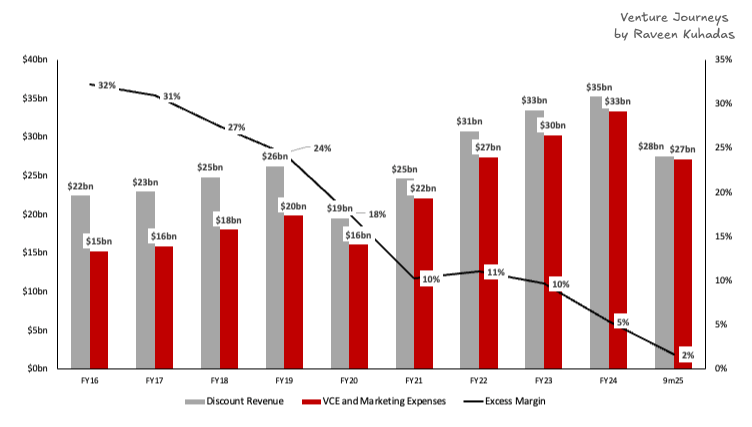

The chart below shows a sharp decline in card reward program margins since 2016, coincidentally the year of the launch of the premium Chase Sapphire Reserve card.

American Express’s card contribution margins* have declined due to increased reward expenses.

* Card contribution margin, defined as non-interest card income less reward (variable customer expense or VCE) and marketing costs

There are two key strategies American Express has used to manage this margin pressure.

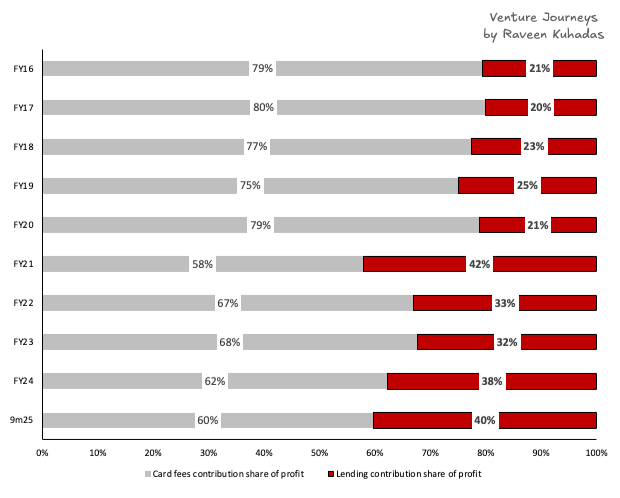

Firstly, it leaned on its most profitable customers. With interest charges of 20-30%, borrowers are American Express’s most profitable customer segment. Contribution margin profit for lending (circa 67%) were nearly double that of cards in FY24.

American Express grew this customer segment through product innovation. It made it easier for its customers to roll over their charges into a credit facility (Pay over Time feature) and launched a Buy Now Pay Later feature (Plan It).

As shown in the chart below, lending’s share of overall contribution margin has nearly doubled to 40% since FY16.

Lending’s share of segment contribution profit* has nearly doubled since FY16

* Lending contribution profit is defined as net interest income less provisions.

There is always an element of risk in lending. It is also a harder service to differentiate - I did not invest in American Express because I think it’s a great bank. However, American Express has been thoughtful to manage the credit risks. It invested in technology infrastructure to understand its customers. American Express runs thousands of risk models every time a card is swiped.

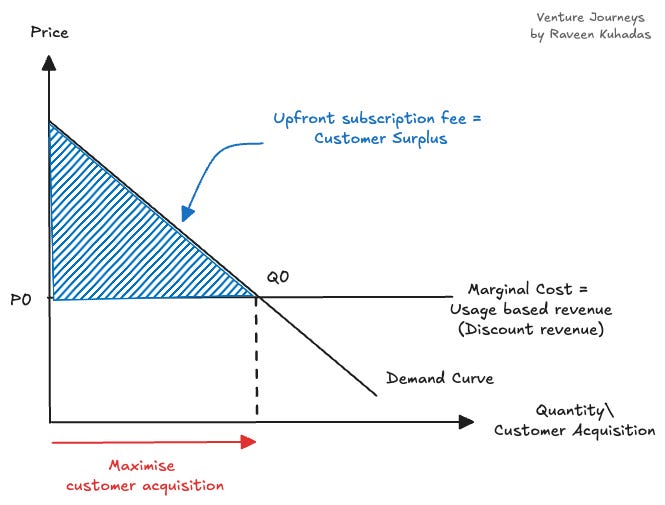

Secondly, it gave its customers more value. In a world of increasing marginal costs, this implies accepting lower margins on the usage based component to encourage more usage.

The key is that customers will find the product more valuable as their usage increases. Therefore, it’s best to price usage based benefits affordably to encourage more usage. For American Express, its best rewards require cardholders to accumulate large point balances. Its annual financial accounts indicate this is exactly what American Express has done.

With increased reward and marketing expenses, American Express now earns minimal margins on its usage based revenue

Discount revenue corresponds to the usage based revenue American Express receives from the 2-3% transaction fee every time members use their card. As the chart above shows, American Express’s discount revenue used to exceed its marketing and reward costs by over 30% in FY16.

In an aggressive competitive response, American Express’s discount revenues now barely cover its reward and marketing costs. Instead, it has captured value from increases in its upfront subscription fee component. From FY16 to FY24, net card fees revenues have increased at ~14% pa compared to ~6% pa for discount revenues.

In economic terms, American Express has priced its usage based revenues (i.e. discount revenue) close to marginal costs (customer rewards and marketing). This is represented by the line P0 in the chart below, which maximises customer acquisition (without incurring losses on every transaction). Profitability or consumer surplus is captured via the shaded area, representing other revenues, with net card subscription fees being the largest component.

American Express’s hybrid model balances customer acquisition and profitability

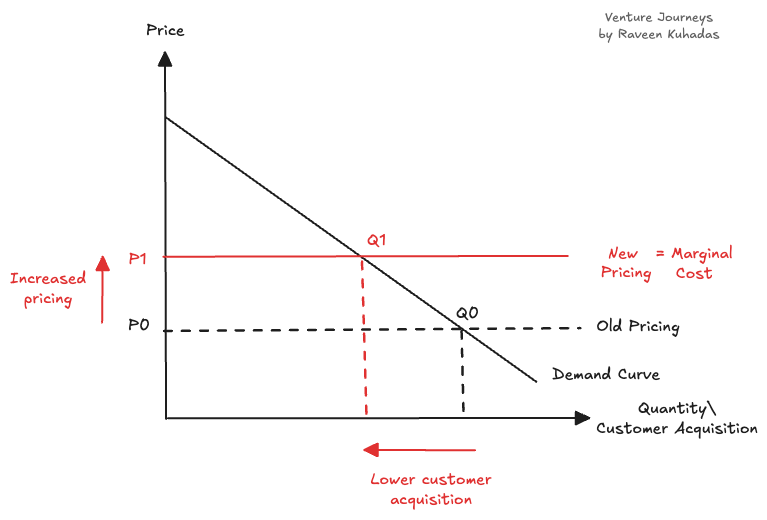

Sacrificing margin also has the effect of putting pressure on an aggressive competitor. JP Morgan’s pricing shift on its Chase Sapphire Reserve card signals it has finally had enough.

The Inflection Point - Competitor Price Changes

“Chase catapulted both the personal and the business Chase Sapphire Reserve credit cards to the top of the premium rewards credit card pile. At least in terms of annual fee at $795 each, but not necessarily in utility or consumer friendliness…we were seeing the increase in annual fees from everybody and the couponization of these cards which hadn’t necessarily had these coupons before…So we were seeing this, you know, negative landslide down in credit card land”, Devon Gimbel and Kelly Wright on the Point me to First Class podcast, September 2025 .

In June 2025, JP Morgan refreshed the pricing on its premium Chase Sapphire Reserve card after four years. As Gimbel and Wright highlight above, the launch represents a tougher deal for consumers with higher upfront fees and rewards that are harder to redeem. The key changes include (full list here):

Increased upfront subscription: JP Morgan sharply increased the annual subscription fee by nearly 45% to $795. To offset this, it introduced $2700 worth of upfront reward credits.

Reduced flexibility: Previously cardholders could earn 3x the reward points on a very broad range of travel services (even including spending on public transit). Now these will earn just 1 point per dollar spent. Additionally, JP Morgan removed the guaranteed redemption rate of 1.5 cents per point on its Chase Travel portal. This was replaced with a 2x points boost for only selected airlines and hotels.

Prioritising direct channels: The new incentives significantly favour higher margin direct channels. Consumers can earn 8x points for flights via the Chase Travel portal. Standard redemptions have dropped over 30% to 1 cent per reward point, unless cardholders book specific inventory via Chase’s Travel portal (the points boost described previously). The new upfront credits have similar restrictions. For example, only dining at “Sapphire Reserve Exclusive Tables” to benefit from the $300 dining credit.

Collectively, these changes amount to a net increase in pricing. Subscription prices have been increased and cardholders are incentivised to book via higher margin direct channels to receive the best rewards. After years of losses, JP Morgan has signalled a shift towards profitability.

“We’ve known for a long time that the Reserve has not been a profitable card for Chase… Because the 3x points for a lower annual fee and then the addition of lounges, like they were losing money on the card, they lost money on the signups, and then they lost money over the years”, Devon Gimbel and Kelly Wright on the Point me to First Class podcast, June 2025.

The Chase Sapphire pricing change signals a shift away from aggressive customer acquisition

Prioritising profitability has significant industry implications. As the above chart illustrates, raising prices suggests JP Morgan is moving away from aggressive customer acquisition. This retreat created a pricing umbrella for American Express to follow suit. In September 2025, American Express announced a refresh of its flagship Platinum card. It raised subscription prices by nearly 30% to $895.

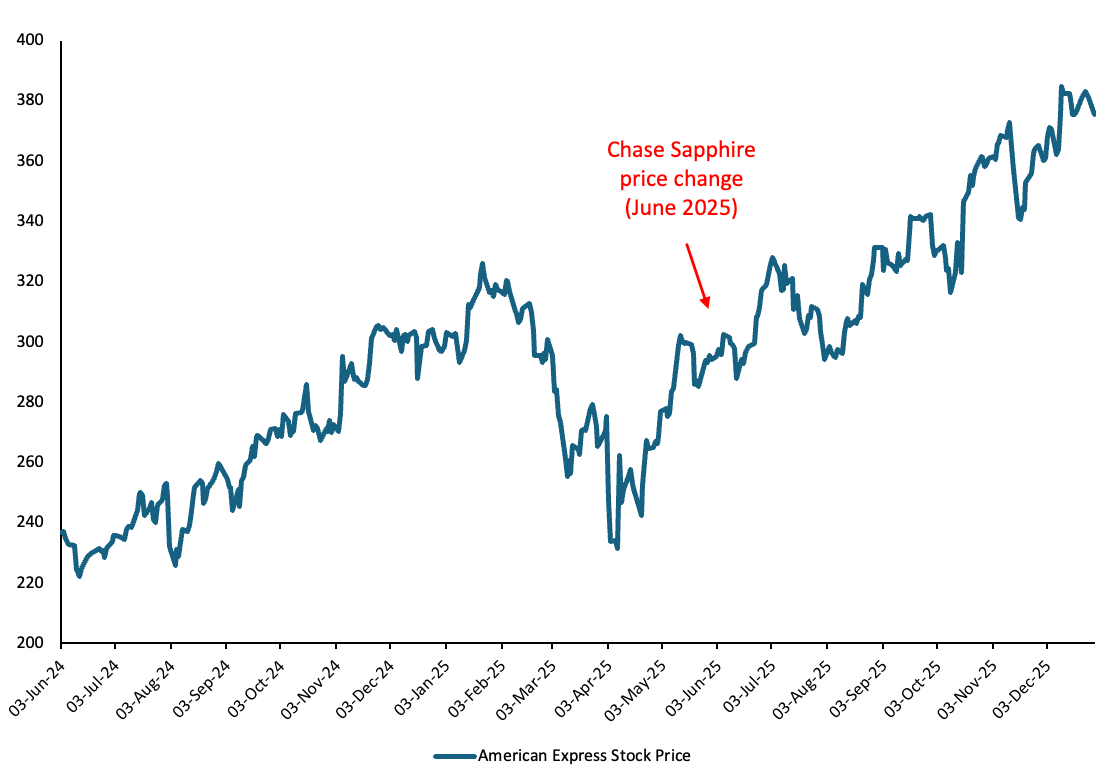

Major competitive pricing changes can represent a significant opportunity for investors. Those of us who invested following JP Morgan’s pricing announcement in June 2025 have seen returns of over 20% in six months.

Investors have seen an over 20% appreciation in American Express’s stock price since Chase Sapphire announced its price change

However, how did American Express withstand a competitive assault from JP Morgan, a company with a market capitalisation over three times its size? This speaks to the strength of American Express’s competitive advantage and the key to its hybrid pricing model.

Closing the Loop: American Express’s Data Advantage

Advertising powers American Express’s hybrid pricing model. It is advertising that allows American Express to tap into over $1 trillion in purchase transactions, a far greater opportunity than what cardholders would be willing to pay for directly.

The key to this is linking cardholder activity to purchase outcomes. Many of its peers, such as Chase Sapphire, are open-loop networks where the network may not include both the cardholder and merchant. In contrast, American Express operates a closed-loop network, which incorporates both the cardholder and merchant. The competitive advantage it gives is described by CEO Stephen Squeri below.

“So I mean the closed-loop networks is really key, right? And fundamentally, what it means is, we have the merchant relationship and we have the cardholder relationship… Well, what it does is it gives you more data… not only from a credit and fraud perspective, which is why we’re the best in the industry on that, but it also gives you more information from a marketing perspective”, Stephen Squeri, American Express CEO at the May 2025 Bernstein Strategic Decisions Conference.

By owning both sides of the transaction, American Express can see which rewards resonate with its cardholders. Such data allows it to both design the right rewards and demonstrate higher conversion to its travel and hotel advertising partners. Seeing the benefits, these advertisers will be willing to fund better rewards (and higher transaction fees), which attracts cardholders.

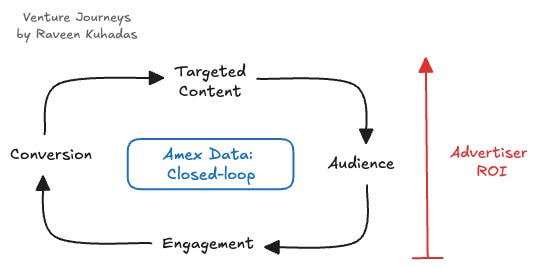

The flywheel below illustrates this dynamic. The closed-loop network powers a higher advertiser return on investment (ROI), which causes them to contribute to better rewards (content) which grow and engage the audience. An engaged audience results in improved targeting and purchasing conversion, resulting in increased advertising funding etc.

American Express’s closed-loop network provides increased advertiser returns

While JP Morgan’s Chase Sapphire program has experienced years of losses, American Express’s data advantage helped it to earn a return on equity of above 30%. Chase Sapphire’s pricing change in June 2025 signals that American Express has successfully withstood a multi-year competitive assault by a much larger peer.

A Case Study in Surviving the AI Land Grab

175 years after its founding, American Express is often thought of as an old-school “blue chip” stock. However, its financial profile suggests a business more akin to technology companies such as Microsoft.

Its pricing strategy and data advantage have allowed it to profitably withstand a multi-year competitive assault from a much larger peer. Chase Sapphire’s announced pricing change in June 2025 signals a significant shift away from aggressive customer acquisition, paving the way for increased pricing in the industry. Investors who observed this shift and competitive implications have enjoyed returns of over 20% in the past six months.

American Express’s hybrid subscription and usage based pricing model also gives investors and technology companies a playbook to succeed during the “land grab” phase of AI disruption. Companies can withstand this by:

Sacrificing margin for usage: Companies should consider sacrificing margin to encourage further usage of the product. Investors should assess if the company has a product that customers find more valuable with usage. Increased usage powers customer willingness to pay and potential data monetisation. American Express’s best rewards are reserved for high spending cardholders.

Cross-subsidise with high-margin customers: Companies will need these customers to support the cost investments discussed above. American Express grew its lucrative lending segment through product innovation and technology investments in data analytics. Investors should assess a company’s ability to leverage this segment. For example, lending accounted for only circa 20% of American Express’s profit in FY16.

Monetising a data advantage: The ability to assess and attribute user activity to commercial outcomes enables a company to capture more of its customers’ budget. This helps justify both upfront subscription costs and usage based charges. I discussed a framework for investors to assess this in a previous article. American Express’s closed-loop network achieved high ROIs for its advertisers, which supported more generous cardholder rewards and transaction pricing.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.