A Simple Framework for Evaluating SaaS Resilience to AI

Assessing the resilience of companies like Salesforce and Canva in the AI era.

“The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

Warren Buffett, Financial Crisis Inquiry Commission Interview

For the past 20 years, SaaS businesses with their lucrative pricing and high gross margins have benefitted from the high perceived value of their products by customers. This has allowed them to build industry defining companies and generate strong investment returns.

However, the advent of AI could be disruptive for this perception of value and comfortable pricing dynamic.

SaaS companies must incorporate AI to increase the value of their products.

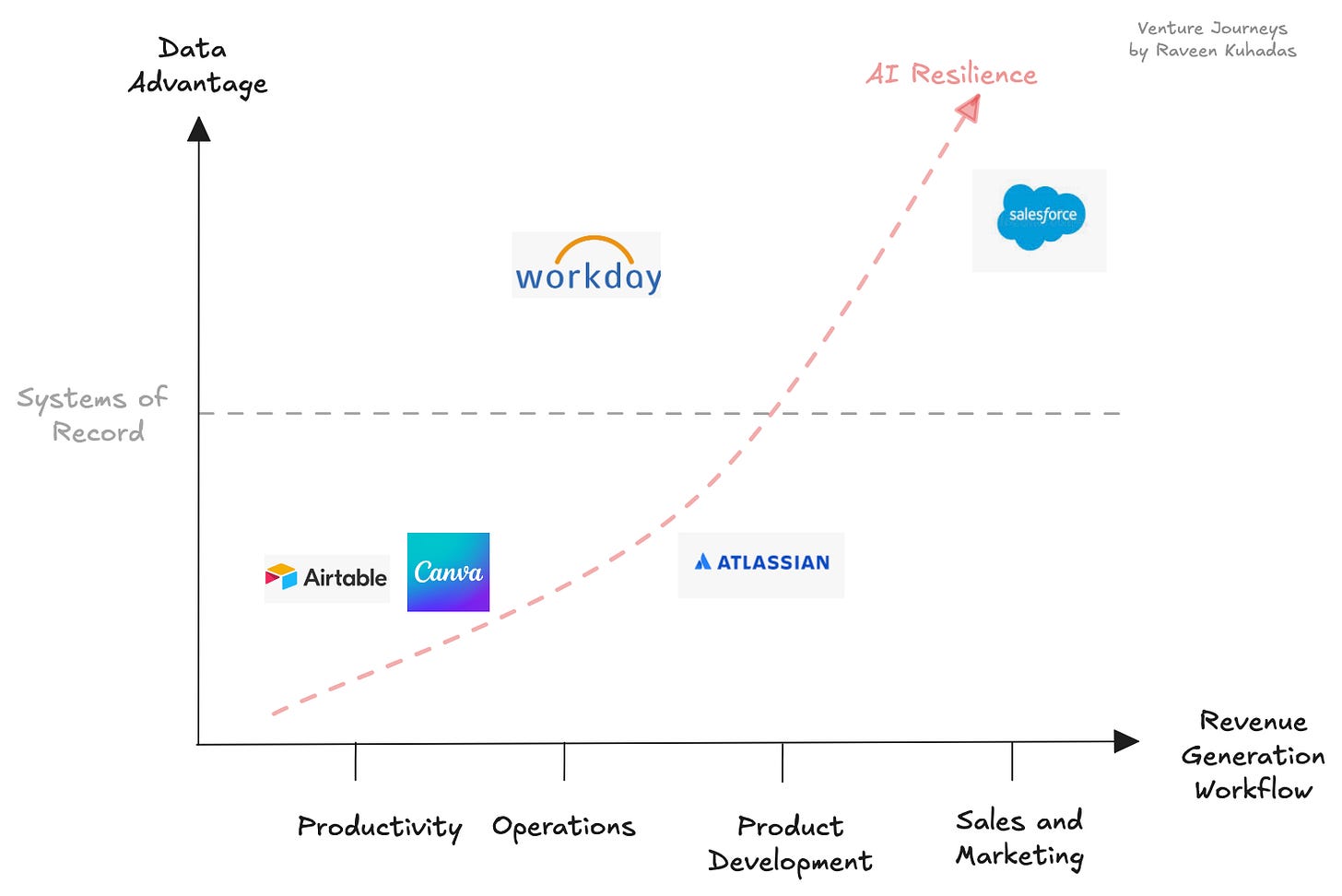

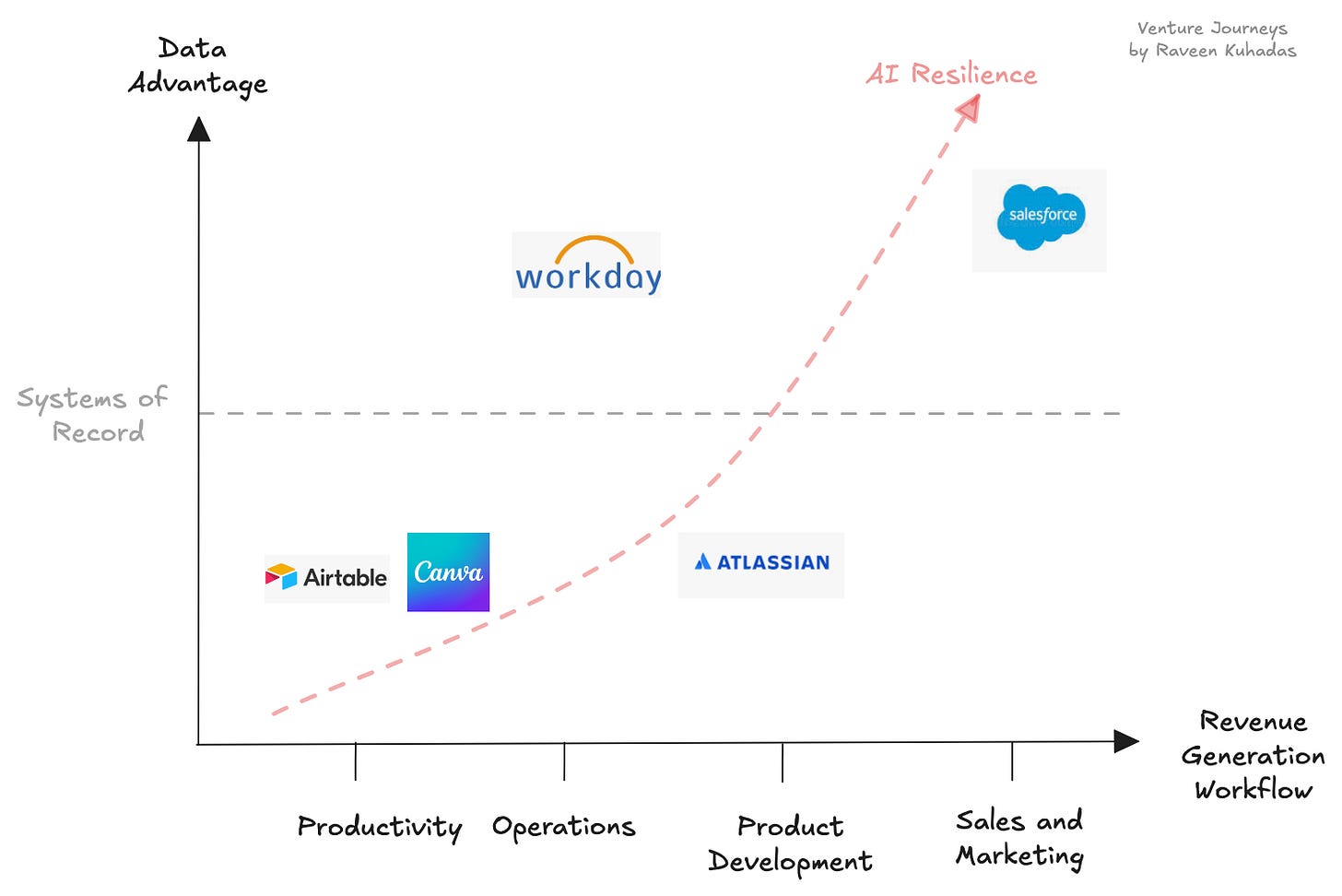

A SaaS product’s pricing resilience depends on its:

Proximity to value: Software workflows closer to revenue generating functions (e.g. sales and marketing compared to productivity) are less likely to be disrupted by AI’s ability to disrupt or cut out workflows i.e. lower gap between perception and value.

Data Advantage: SaaS companies must incorporate AI to improve the value of their products. The effectiveness of AI models depend on the quality of the data they ingest. Systems of Record like Salesforce and Workday have inherent data advantages.

Companies like Salesforce occupy the high ground - they have proximity to value and inherent data advantages.

However, SaaS companies like Canva show how this risk of disruption is being managed. It is building a Data Advantage that focuses on the basic value drivers of freemium models such as improved time to value and ROI.

A special thanks to Ibrahim Bashir, whose writing and course on B2B SaaS helped inspire this article. Ibrahim has executive software engineering experience at global technology firms like Amplitude, Amazon, Twitter and Box.

This article will explore the pricing conflict AI can create for SaaS companies, a framework to consider what type of SaaS companies are most resilient to this shift and Canva’s strategy to succeeding in the face of AI. *

* All opinions are personal. This is not investment advice.

Pricing Conflict and the Proximity to Revenue

SaaS companies, with their subscription based revenue models and troves of user data, have benefitted from value based pricing.

Through a strong understanding of their customers, companies price their products according to their perceived value. Pricing is thus untethered from their cost of production or competitor pricing.

As such, SaaS companies like Salesforce have enjoyed high gross margins which has driven strong investment returns over the past 2 decades. Pioneers like Salesforece and Workday are valued at circa $230bn and $67bn today compared to their IPO market capitalisations of $110m and $637m respectively. Canva is valued at $26bn despite being founded just over a decade ago.

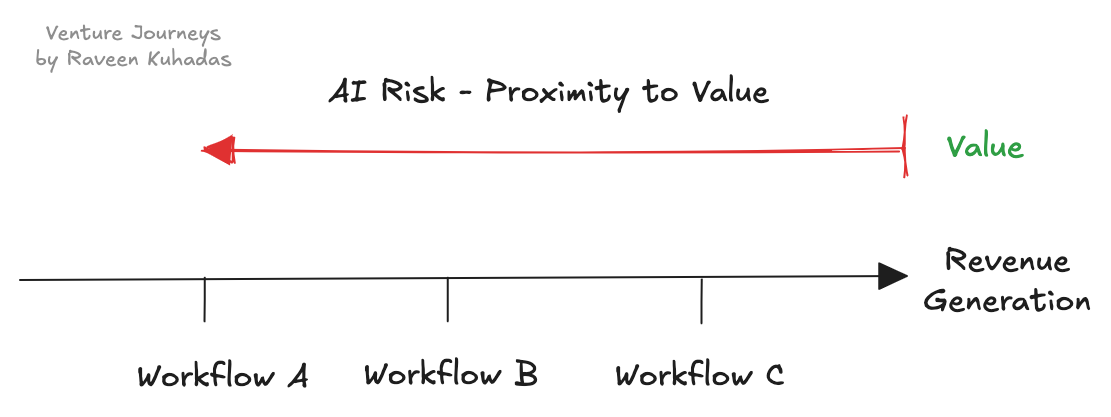

However, not all SaaS companies are created equal. Most SasS products digitise the workflow users take to complete a task. As Ibrahim highlights in his article, the perception of users change, the closer the workflow is to “the path of revenue”.

Software digitising workflows further away from revenue generation activities, tend to have pricing conversations that sound like:

Our software makes your employee more efficient at Workflow A.

Workflow A contributes to Workflows B, C, D etc.

Eventually, these workflows will result in generating $X of revenue.

Our software pricing is only a fraction of $X. What a bargain!

In contrast, workflows relating to the customer’s revenue generating activities are less likely to face conflict over pricing. Customers can more clearly link the workflow to revenue and calculate the software’s ROI.

“... if you’re helping an enterprise be more productive, they look to you on how to think about productivity and translate that into an atomic unit that you can price around; but if you’re in the critical path of their workflow, they are well versed in how their business makes money, and your product’s value is measured solely in terms of lift to that overall metric.”

Ibrahim Bashir, Amplitude VP of Product Management, Run the Business newsletter

SaaS companies face disruption due to AI’s ability to disrupt workflows. This would impact customers’ perception of value, creating pricing conflict. It could even make entire workflows obsolete. The further the proximity of the workflow from revenue generation, the higher the risk of disruption.

“AI is a shortcut into the path of revenue, and a much more direct play …. most pricing today is abstracted away from business value and more oriented on the internal employee job to be done.”

Ibrahim Bashir, Amplitude VP of Product Management, Run the Business newsletter

The key to resilient pricing is to leverage AI to increase the value of the software. This would depend on the quality of their data.

Systems of Record and Their Data Advantage

The disruptive effects of AI on SaaS companies are yet to be fully understood. However, the quality of data directly impacts the performance of the AI models and therefore, the value of their new product offerings.

Salesforce and Workday belong to a special group of SaaS companies called Systems of Record, that have an inherent data advantage.

A system of record acts as a database that is the source of truth for mission critical company data. A company can have several systems of record relating to key functions such as Sales & Marketing (e.g. Salesforce) or Human Capital Management (e.g. Workday).

Systems of Record have the following data advantages:

Accuracy: They manage the key data units for a business function, serving as a ‘source of truth’ with a unique reference ID for any related data. This keeps the data accurate and up-to-date. For example, Salesforce’s various CRM clouds create a unique Salesforce ID when the company records a new sales lead or customer. Any subsequent updates, in Salesforce or other connected enterprise systems, are automatically reflected.

Integration with Other Systems: They integrate with other enterprise software, allowing the data to be synchronized across departments. This means that updates in one system, such as Salesforce, are immediately reflected in all connected systems. This results in frequently updated, accurate data.

Contextually Rich Data: When Systems of Record integrate with other systems, they pool data from different departments and functions. For example, integrating Salesforce (CRM) with an ERP system adds financial and operational data to the customer records. This gives a fuller picture of the customer, combining sales interactions, purchase history, and financial health. As a result, the data becomes richer with additional context, allowing for deeper insights.

Over the past 2 decades, these companies have grown to be leading players in their industries. For context, Salesforce has a market capitalisation of over $230bn and has a market share greater than its 4 major competitors combined.

Source: Cyntexa and Statista

Systems of Record have a leg-up in dealing with AI disruption. Consider the comments from the CEOs of Salesforce and Workday.

“Each day, hundreds of petabytes of data are created that AI models can use for training and generating output. But the one thing that every enterprise needs to make AI work is their customer data as well as the metadata that describes the data, which provides the attributes and contacts the AI models need to generate accurate, relevant output. And customer data and metadata are the new gold for these enterprises. And Salesforce now manages, as I mentioned, 250 petabytes of this precious material.”

Marc Benioff, Salesforce Founder and CEO, 1Q25 Earnings Call

“So when we think about AI, I think we're taking a slightly different approach to thinking about AI, specifically on how we're going to monetize it... We think it's important that all our customers get access to AI that's built deep into our platform, taking advantage of our highly curated data set. We have 65 million users processing 800 billion transactions a year on our platform.”

Carl Eschenbach, Workday CEO, Jefferies Software Conference 2024

A Framework for Pricing Resilience to AI

To avoid disruption, SaaS companies must leverage AI to increase the value of their software. Their ability to do this depends on:

Proximity to Value: Software closer to revenue generating workflows reduces the difference between the customer’s perception and realised value. It also makes the workflow less likely to be disrupted by AI. SaaS companies like Salesforce occupy valuable digital real estate in the Sales and Marketing function. Customers can more easily estimate the software’s ROI, reducing the potential for pricing conflict.

Data Advantage: The effectiveness of AI powered products is dependent on the quality of data they ingest. Systems of Record such as Salesforce and Workday benefit from accurate, contextually rich data.

Companies like Salesforce occupy the high ground as they have inherent Data Advantages and operate close to their customers’ revenue generation workflows.

However, companies at the bottom left of the chart like Canva, are certainly not standing still.

Canva - Building a Data Advantage and Going Back to the Basics

Canva’s AI strategy is to build a Data Advantage that significantly reduces the friction for its users to derive value out of its product. As Ibrahim discusses in his article on B2B SaaS growth strategies, levelling up subscribers to become power users is an important step in growing penetration and monetisation in enterprise customers.

Founded in 2013, Canva is an online platform for the design of creative visual content used in areas such as social media advertising campaigns. With a valuation of US$26bn, it is one of the world’s most valuable private companies.

Canva faces disruptive challenges due to its Proximity to value. Designing the creative or visual content is an important workflow in a social media marketing campaign. But what matters is the successful conversion of these advertisements.

Platform owners such as Meta have closer proximity to conversion due to owning the relationship with the consumer.

“You think about Canva being super popular for Social Media marketing…I’m very bullish on Facebook’s generative AI ads products where it’s not just where you go in - they will find the customers for you… The truth function in this case is not “is the creative good”. It’s “does the creative lead to conversion”. And that can all be done algorithmically without any humans in the loop… So there is a bit there where this market that has been a very strong market for Canva is under threat. Because what’s even better for not having to go to the designer - not having to actually make any creative at all”

Ben Thompson and Andrew Sharpe, SharpeTech Podcast

In response, Canva has improved its image library by partnering with leading providers like Getty Images.

“This partnership gives Canva an advantage that differentiates it from Adobe’s offerings. The Getty Images library includes more than 350 million images, which compares to 248 million for the Adobe Stock library (including photos, illustrations and vectors).”

Forbes Contributor Melody Brue, Moor Insights and Strategy

This data will feed into its own AI foundation model after its recent acquisition of Leonardo.AI for over $80m.

Leonardo.AI's generative AI models allow users to easily create high-quality images from simple and guided text prompts.

Essentially, Canva use of AI goes back to the basic value drivers of the freemium or product-led growth SaaS model.

Conclusion

Nearly 2 decades ago, SaaS pioneers like Salesforce disrupted traditional software models with their innovative subscription pricing and cloud based value proposition.

Faced with being disrupted themselves, SaaS companies are investing heavily in AI to improve the value of their products.

Some companies are better positioned, occupying valuable digital real estate and possessing inherent data advantages. Others are building more value into their products through focusing on the fundamental drivers of value for freemium SaaS businesses.

Whether you are an investor, founder or consumer, these are exciting times.