An Interview with carsales’ CEO Cameron McIntyre

On Founder Succession and Long-term Growth

Leadership transitions are complex and risky. A Harvard Business Review study found that poorly managed transitions cost the S&P 1500 nearly $1tr per year. The risks are even higher for founder-led businesses, given their deep attachment to their businesses.

However, if done right, the same study found company valuations could benefit by 20-25%.

6 years after Cameron McIntyre succeeded founder Greg Roebuck, carsales is a valuable example of a transition done right.

Following my previous article on carsales, I’m grateful for the opportunity to interview Cameron on how he achieved this feat and how his people centric approach has driven the growth and international expansion of an $11bn business. Let’s dive in.

Article Summary Points

Founder successions are risky but unlock growth when done well. It’s a long process, which requires building trust with the founder and fellow executives.

The right successor is crucial as they will redefine the organisation based on their strengths; Cameron's journey, marked by his expertise in marketplaces, international acquisitions, and unique people-centric perspective, positioned him as the ideal candidate.

Leveraging his strengths in organisational change and people management, Cameron created a structure that elevated executives, achieving their buy-in for his leadership transition.

He combined this with a culture of transparency and accountability. The result is an organisational structure that facilitates sustainable growth as executives could be added while maintaining consistent decision making.

carsales’ organisational structure and culture created the foundation for its successful international expansion. Local executive buy-in is key to the adoption of new products and technology that will drive growth in the acquired businesses.

* All opinions are personal. This is not investment advice

The Secret to Successful Founder Succession

Founders tend to build their businesses around themselves. They are heavily involved in major decisions.

While such an approach can work well during the earlier stages, it can limit growth as the business scales and becomes more complex. A well planned succession process will allow the business to effectively capture the next stage of growth.

However, it is no easy feat. Founders have their identity inextricably linked to the business they built. Stepping away is an emotional and difficult process.

carsales achieved a masterful outcome where Greg

Gave Cameron the freedom to exercise his leadership as CEO by stepping away from carsales’ executive leadership and from the Board.

Remained supportive of the transition and of Cameron's ascension to CEO. He maintains a close personal relationship with Cameron.

“I’ve also opted to step down from the carsales Board to ensure a clear runway for Cameron as the incoming CEO but will remain close to the business.” carsales co-founder Greg Roebuck, January 2017

How was this achieved? My conversation with Cameron highlighted 3 key ingredients for a successful transition:

Creating Trust with the founder through a professional and personal relationship

Unlocking Growth in the business through increased executive autonomy

Creating Buy-in with fellow executives to support the leadership change

There is a strong personal element to building trust. Who is Cameron McIntyre? This is his journey.

Cameron’s Journey to carsales

It was 2007. carsales was growing rapidly and Greg needed a CFO.

The stakes were high. Many of us have seen how the wrong senior hire can cripple a business.

With a career in legacy businesses such as manufacturing and publishing, Cameron seemed like an unlikely candidate for a disruptive startup like carsales.

What got him across the line? Cameron’s journey displayed all 3 elements needed for a successful senior hire - Cultural Fit, a Unique Perspective and Relevant Experience.

Cultural Fit

Befitting a startup’s culture, Cameron had a strong affinity to entrepreneurship. His father ran a print distribution business called Celmac. Cameron himself dabbled in business ventures while he was studying accounting in university.

Unlike your typical accountant, he was hands-on. Early in his career, he was working closely with the people on the manufacturing floor while working at British American Tobacco and L’Oreal. He viewed things strategically.

“In manufacturing, it’s about inputs, processes and outputs” Cameron McIntyre

Cameron began to see people as the inputs. As we will see, this would become a feature of his leadership career.

Unique Perspective

The benefits of a senior hire lie in their unique experiences through their careers. Cameron’s leadership style is defined by his belief in empowering people.

“There are 2 types of leaders. Those who surround themselves with people that are better than them and those that surround themselves with people that aren’t as good. I’m the first type of leader.” Cameron McIntyre, carsales CEO

He learned the leverage people could give an organisation from John Kotter while attending a management course at Harvard University. John is a leading voice on business leadership and organisational change.

His management frameworks emphasise communication, motivation and collaboration. These would become essential tools as Cameron transitioned to CEO.

During one of John’s lectures, he made a comment that would shape Cameron’s decision to leave a prestigious corporate job for a disruptive startup.

“Life is short. Do something cool with it” John Kotter

Relevant Experience

Cameron’s experience at Sensis made him well-versed with the dynamics of a rapidly changing classifieds industry.

In 2007, with nearly $2bn in revenue and $800m EBIT, Sensis was a high profile division within the Australian telecommunications giant Telstra.

It was a major player in the classifieds advertising industry, with formerly ubiquitous brands like the Yellow Pages and Trading Post.

However, being a legacy print business, it was being rapidly disrupted. As Finance Director, Cameron worked on Sensis’s nascent digital strategy. He closely studied the disruptive online players like REA (property), carsales (auto), Seek (employment) and Wotif (travel).

However, management balked at moving away from its lucrative print business. They lacked the entrepreneurial vision that would appeal to Cameron.

It was during this time that a recruiter called about a CFO position at carsales.

Building Trust - A Professional and Personal Connection

To unlock the next stage of growth, an incoming CEO needs to build an organisational structure around her/his strengths. However, this change is risky. Doubly so for founder led businesses given their influence throughout the business.

carsales was no exception. Like many founders, Greg was involved with all aspects of the product and the organisation’s decision making, revolving around him. Changing this structure would be impossible without Greg’s support.

This is why building trust with the founder is crucial - it began with Cameron’s first meeting with Greg when interviewing for the CFO role.

“We got along well. Greg even agreed to have my next interview in a bar. We sat for 3 hours chatting and drinking beer” Cameron McIntyre

Professionally, Cameron was dependable and a high performer. He prepared the business for IPO in the midst of the GFC while also running the private seller business. He also embodied Greg’s culture of paranoia towards competitors and of “owning every dollar”.

Importantly, Cameron built a personal connection with Greg. Both of them loved cars. Their daughters went to the same school. Greg gave his support to Cameron’s succession and they remain close friends today.

“Cameron’s nine years of service to carsales have been marked by outstanding performance and he has demonstrated remarkable talent and sound judgment in everything he does. The Board believes his appointment reflects the strength of the company’s succession planning and the quality and depth of its management team.” carsales Chairman Jeffery Browne on Cameron’s CEO appointment, January 2017

Creating Buy-in - Elevating Executives

“Greg built the organisation around product, which was his strength. My strength is empowering people… The conversations shifted from tactical product considerations, to strategic talent considerations. ” Cameron McIntyre

With Greg’s endorsement, Cameron was free to restructure the organisation. However, he still needed his executives to buy into his leadership.

Cameron had an important insight - if the business was to grow, its people had to be empowered to grow as well.

His set up a new organisational structure that

allowed for more executives at the leadership table and

empowered them with more autonomy.

With their positions elevated, executives were incentivised to support this new structure. However, it also comes with risks.

Creating Sustainable Growth - A Culture of Transparency and Accountability

To grow sustainably, carsales has to keep track of the activities of all these newly empowered executives and hold them accountable.

There is a natural tension between autonomy and organisational control. Greater autonomy promotes executive buy-in, innovation and dynamism. However, it can come at the cost of accountability and increased risk.

We can visualise this tension through 4 types of leadership styles:

Autocratic (high control, low autonomy): Seen in ‘old world’ industries such as manufacturing

Saboteurs (low control, low autonomy): Ineffective leaders who are not competent enough to provide meaningful guidance but too insecure to allow staff autonomy

Empowering (low control, high autonomy): High levels of autonomy promotes creativity and innovation. However, the lack of standardisation of activities could lead to inconsistent results

Aspirational (high control, high autonomy): A utopian leadership outcome, with empowered employees and high levels of control. Control is achieved indirectly through a strong organisational culture

carsales’ unique culture of transparency facilitates an Aspirational leadership style that promotes sustainable growth.

Executives are kept accountable through frequent communication within the business and with external stakeholders.

“Communication is key. We have weekly meetings where we share our successes and learnings. There is full transparency and accountability. While our executives are competitive on their results, everyone gets along.” Cameron McIntyre

Additionally, Cameron exposes his executives to the impact of their actions.

“My executives are allowed to hold investor meetings. I want them to feel the joy when our business delivers. But also the pain when it doesn’t. I use the market as a way to keep us accountable.” Cameron McIntyre

This transparency extends to the Board. Directors regularly hold meetings with executives and senior leaders.

“Through these meetings, the Board has an operational understanding of the business. They are brought along on the journey and are therefore comfortable making fast decisions” Cameron McIntyre

Cameron’s strategic approach to leadership and a culture of transparency allows for both executive autonomy and organisational control. It’s a scalable structure that allows him to add executives to grow the business sustainably.

This laid the groundwork for the international acquisitions that would transform the business.

International Expansion - Combining Strategy and Culture

Merger and Acquisition (M&A) transactions, while glamorous and transformative, are often risky ventures. A significant number of M&As fail to add value to the acquiring business.

Yet, with over $2 billion spent on international acquisitions in just two years, Cameron’s strategy was far from an impulsive decision; it was a calculated move that had been years in the making.

This is where Cameron’s previous experience and organisational changes come together. His insights were to:

Acquire dominant marketplaces that benefit from network effects

Create local executive buy-in that will enable growth

“Why was I so confident the acquisitions would work? Because I’ve seen how it can work and how it can fail.” Cameron McIntyre.

Cameron’s approach to international expansion is threefold, involving strategy, cultural fit and executive autonomy.

In my previous article on carsales’ strategy, I highlighted how the market leader benefits from network effects. This principle is evident in carsales’ international acquisitions, which have the largest audience in their respective markets.

“We buy businesses that we can grow, not those that we need to fix.” Cameron McIntyre.

Prior to carsales, Cameron was a senior finance executive at Email Ltd. He witnessed the acquisition of the company by Swedish acquirer Assa Abloy Group. This experience served as a blueprint for successful integration, emphasising a shared culture of collaboration and intellectual property sharing.

“That’s why we started with smaller stakes before buying them outright. Culture doesn’t come up in due diligence. We needed time to assess it.” Cameron McIntyre

His strategy also involves empowering local executives by offering elevated positions and autonomy. These executives find themselves with more autonomy and resources to grow their business.

By allowing them to grow, Cameron creates executive buy-in.

“I think, what we are most excited about is that we have a team that we're aligned with, that we're excited about working with and that we really want to be able to move forward on some of those longer-term transformations within the company.” Lori Stacy, Trader Interactive CEO

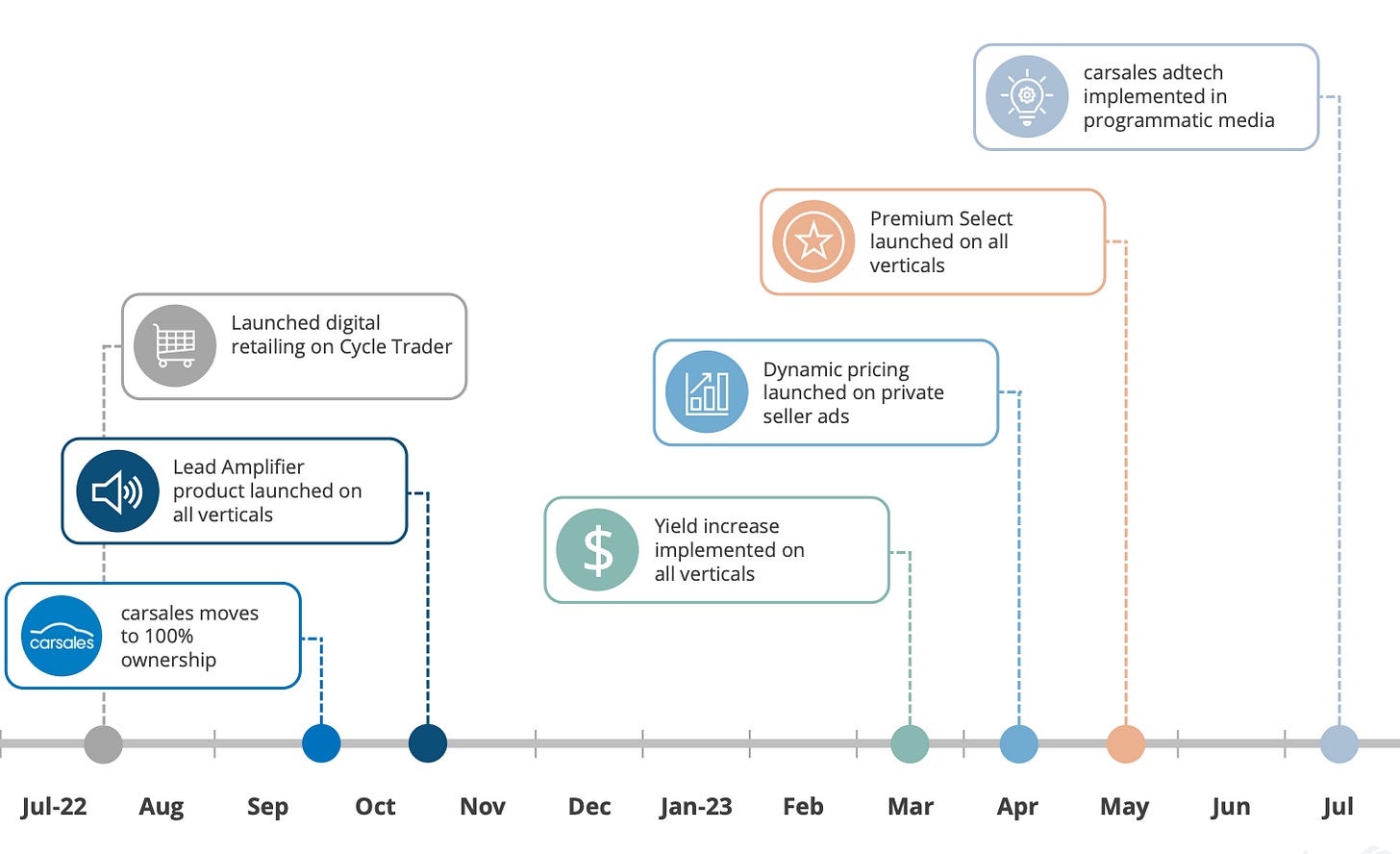

Executive buy-in is key to the adoption of new products and technology that will drive growth in the acquired businesses.

Conclusion

Navigating founder successions is delicate and risky. Yet with trust and executive support, it can drive further growth.

At carsales, CEO Cameron McIntyre has successfully fostered a culture of empowerment and transparency, laying a solid foundation for the company’s ambitious international expansion.

This approach has allowed for a scalable and accountable organisational structure, crucial for consistent decision-making and long-term growth.

People are a key part of understanding competitive advantage and a big reason for my writing on Venture Journeys. My conversation with Cameron has reinforced my confidence in carsales' strategic direction and future prospects.

I welcome your thoughts on founder succession and leadership change. Feel free to share this article or reach out with your insights.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.