carsales- Winning the Audience and Profitable Marketplace Growth

Driving marketplace competitive advantage and growth through prioritising customer outcomes.

A focus on customer outcomes has been a feature of carsales, an online classifieds marketplace, ever since co-founder Greg Roebuck saved the business over 20 yrs ago.

In the internet era, customer outcomes mean one thing - winning the audience. More than most marketplaces, carsales has built its model around this.

carsales spends heavily on Sales and Marketing, generating high levels of engagement and advertising return on investment for its customers. As a result, it has won the audience in Australia and dominates the Australian market for the buying and selling of used cars. Margins are therefore far higher than its peers.

But this isn’t your usual mature cash cow. With take rates of only 7-8%, carsales has yet to fully monetise the engagement on its marketplace.

This is about to change. Its innovative new products like Select and Instant Offer, are poised to unlock higher take-rates.

At the same time, carsales spent over $2bn to acquire controlling stakes in international marketplaces. Such an investment reflects the significant audience market share these businesses have captured. Fuelled by carsales’ enlarged product portfolio and technology, these acquisitions set the business up for growth over the longer term.

These initiatives give carsales a compelling combination of growth, profitability and value.** It follows a two decades strategy of maximising customer outcomes, a big theme of the blog.

My sincere thanks to the fund managers and analysts for your invaluable insights and engaging discussions for this article. Let’s dive in.

Table of Contents

Customer Outcomes and carsales’ Founding Journey

The Rise of Online Marketplaces

The Internet Era - All About Winning the Audience

A Highly Efficient Business Model

An Evolving Marketplace

A Global Opportunity

Conclusion

* *All opinions are personal. This is not investment advice.

Customer Outcomes and carsales’ Founding Journey

In the late 1990s, Greg Roebuck and Wal Pisciotta seized the opportunity to revolutionise the way Australians would buy and sell used cars. They founded carsales.com (carsales).

Today, carsales is the leading online platform for buying and selling used cars, but its success was hard-won.

carsales operates on a marketplace business model, connecting used vehicle sellers with interested buyers. To be valuable to consumers, Greg and his team had to overcome the challenge of convincing dealerships to list their inventory on the platform.

"You had to spell 'internet' to people in those days," carsales Founder Greg Roebuck

In those early days, they went the extra mile, physically visiting car dealerships to collect information, take pictures, or manually input data. Their dedication to making it easy for dealerships to join carsales was crucial to their growth.

The journey was not without difficulties. carsales initially struggled with profitability and faced limited access to capital after the dot-com crash. In 2002, it was losing $200,000 per month with only $600,000 left in the bank.

It was then that Greg made a pivotal decision that transformed its fortunes. He changed the pricing model, charging dealerships based on customer enquiries rather than a fixed price per listing. This incentivised dealerships to work harder to convert enquiries into sales. For private sellers, carsales introduced a fixed fee until the vehicle was sold. These customer-centric changes led to profitability in 2002.

Today, carsales boasts a valuation of $9 billion, a testament to their resilience and commitment to customer satisfaction. Their early focus on understanding customer needs and providing value has become deeply ingrained in their culture.

Current CEO Cameron McIntyre, who worked closely with Greg, continues this legacy of customer centricity. Under Cameron’s leadership, carsales is embarking on its most ambitious venture yet, with customer outcomes remaining pivotal to its success.

The Rise of Online Marketplaces

Over 20 yrs ago, newspapers used to be a bundle of 3 products:

Content: Journalistic content attracted and engaged a large audience.

Advertising: Companies placed their advertisements alongside the newspaper’s content. I.e. companies were paying for the attention of an engaged audience.

Classifieds: Thanks to their large audience, newspapers were a great platform to bring buyers and sellers together to transact. Examples include buying a used car, applying for a job or buying a house.

Classifieds were so profitable that they were described as ‘Rivers of Gold’. A local newspaper could have 80% of its revenue coming from advertising, of which two-thirds was from classifieds advertising.

Naturally, this attracted the attention of a new generation of internet based companies like carsales.

The internet was clearly a superior platform for the classifieds advertising of niche products like used cars. Newspapers are a blunt instrument, good for reaching many people with a mainstream message. Due to space constraints, newspapers disproportionately favoured the most popular products.

However, online marketplaces, benefitting from the virtually unlimited space of the internet, were able to cater to the "long tail" of classified advertisements like individual used cars. Long tail volumes can be significant. For example, in search they can make up 70% of the volume.

Combining this inventory in one place created a customer value proposition that newspapers couldn’t match. Online classifieds companies would take the lion’s share of the classifieds advertising dollars over the next twenty years.

Their success illustrates how explosively disruptive the internet has been to once dominant business models like newspapers.

The Internet Era - All About Winning the Audience

Ben Thompson, Clayton Christensen and others have written about the disruptive nature of the internet.

Before the internet, legacy companies could build competitive moats by investing in physical assets that allowed them to control access to supply.

For example, newspapers owned expensive printing presses which made them monopolies for consumer readership in a geographic region. It was too expensive for a competitor to enter as the local area couldn’t support the fixed costs of additional printing presses. It wasn’t the quality of the content that made newspapers great businesses, it was their stranglehold on distribution.

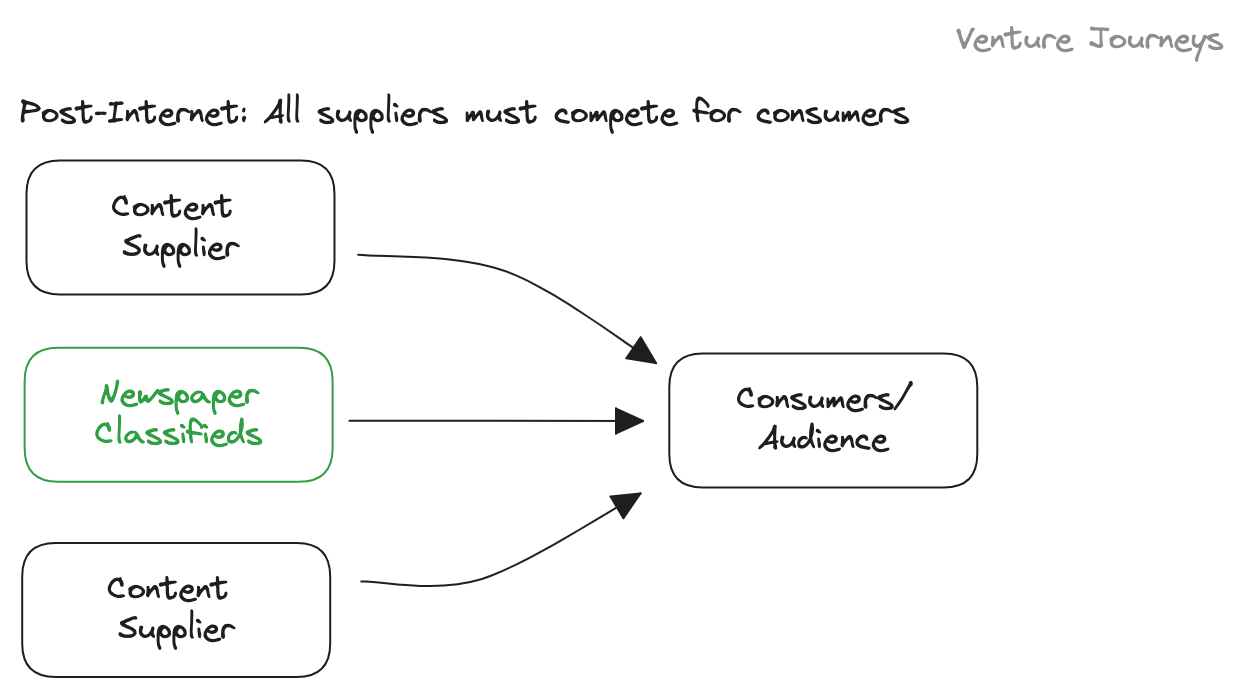

The internet drastically reduced the cost of distribution. Readers could now get their news directly from any supplier with just a few clicks. Newspapers now have to compete for audience attention like any other supplier.

Given the abundance of supply, the winning strategy in this new era would be to aggregate demand. We’ve seen this in success stories like Facebook, Amazon and Google.

For online classifieds businesses like carsales, it became all about winning the audience.

A Highly Efficient Business Model

“Our game plan was always focused around the consumer…We are very focused on outcomes.” Cameron McIntyre, carsales CEO

This customer-centric approach is not just a philosophy, but the engine that powers carsales' business model.

Standing out is a challenge. Giants like Google and Facebook dominate customer acquisition, making it hard for businesses to scale. However, successful marketplaces like carsales leverage the power of network effects. In simple terms, this means that the more buyers and sellers that use the platform, the more attractive it becomes to even more buyers and sellers. It's a virtuous cycle that fuels growth.

Despite this, carsales invests heavily in sales and marketing, dedicating 18% of its revenue to these efforts. This is a significant amount, even when compared to fast-growing marketplaces like Uber and Airbnb.

Why this substantial investment? The answer lies in two key areas: delivering customer value and gaining a competitive edge.

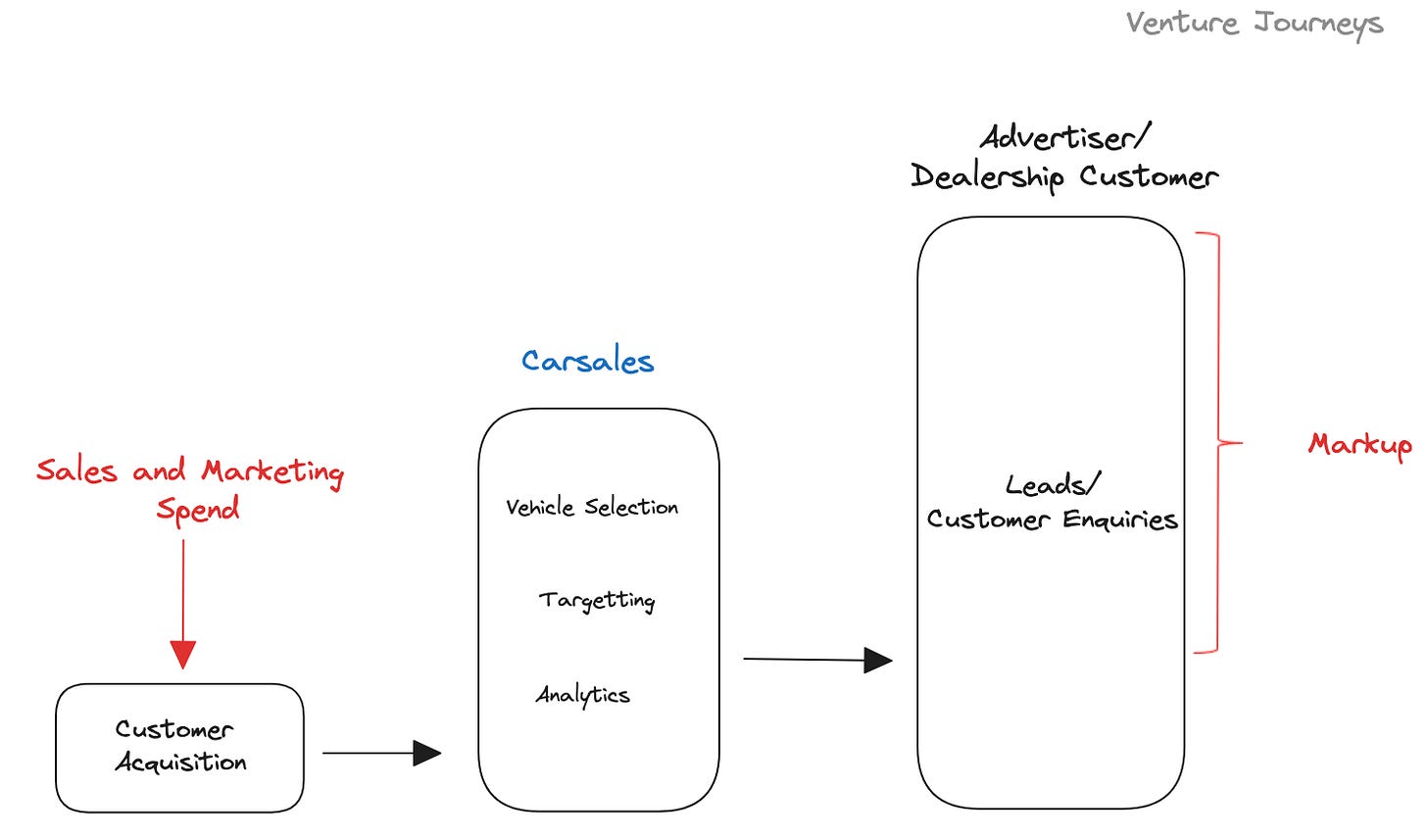

carsales operates as a customer acquisition channel for used car advertisers. It attracts consumer traffic, transforms these visitors into valuable leads, and then sells these leads to advertisers at a markup.

This commitment to customers is further demonstrated by carsales' on-the-ground salesforce in Australia, which actively engages with dealership customers. As a result, carsales has a larger audience, attracts more used car inventory, and achieves higher engagement than its peers. This leads to more sales and a higher return on investment for customers.

As a result of its consistent investment, carsales dominates its market for used cars to a greater extent than its classified peers.

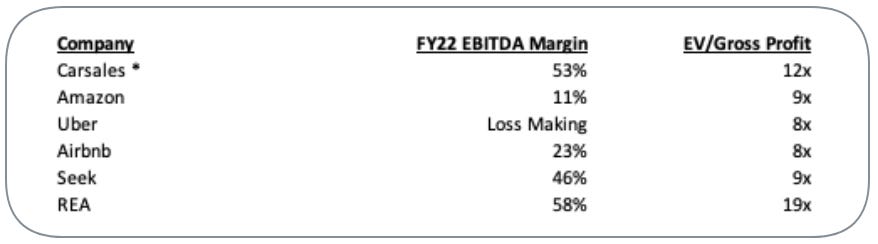

Winning the audience battle allows the company to be exceptionally profitable, boasting over 50% EBITDA margins.

Looking ahead, the opportunity for growth lies in leveraging its high levels of engagement to evolve the marketplace.

An Evolving Marketplace

The used car marketplace is notorious for its inefficiencies and transactional complexities. Each used car is unique, necessitating negotiations and incurring substantial transaction costs. For instance, a new car loses 10%-15% of its value the moment it leaves the dealership, and another 10-15% by the end of the first year, a depreciation that does not correlate with the vehicle's performance.

This inefficiency presents an opportunity. Marketplaces like Airbnb and Uber have demonstrated how reducing transaction costs and enhancing user experience can expand markets, with take-rates significantly higher than carsales’.

With its new products, carsales is poised to do the same in the used car market.

carsales’ innovative new products such as Select and Instant Offer, allow for fixed-price buying and selling of used cars, respectively. These offerings, along with carsales' Encar Home service in Korea which handles vehicle delivery logistics, are designed to streamline the transaction process, reduce inefficiencies, and enhance customer experience.

These new products yield higher returns than carsales' traditional lead generation model.

However, their success hinges on the cooperation of used car dealerships on the supply side of carsales' marketplace.

Unlike its traditional lead generation model that simply connects buyers and sellers, these new offerings require a higher level of standardisation, quality inventory, and service from dealerships. They mirror standard eCommerce transactions, with fixed prices and commitment required from only one party.

Why would dealerships agree to support this? They recognise the potential for market growth. By reducing the inefficiencies inherent in used car transactions, carsales can expand the market and justify higher take-rates. In fact, carsales estimates that the potential market for these new products in Australia is nearly as large as its existing market.

carsales' innovative new products allow it to capitalise on its high engagement levels. They also expand carsales’ playbook for its overseas markets.

A Global Opportunity

2023 marks an important milestone in carsales’ history. For the first time, its international operations are projected to constitute over half of the business, a substantial leap from just over 20% from an underlying basis in FY17. carsales is now a global technology business.

But it took an ambitious bet to get here. The company spent over $2bn to acquire controlling stakes in overseas marketplaces. For a company with a $9bn market capitalisation, this is a significant amount especially considering the high multiples paid.

The high prices were a calculated move given the company

Strategically targetted established marketplaces that had already captured significant audience share.

Took initial stakes in these acquisitions and successfully grew them before taking full ownership. The earnings of Webmotors and SK Encar nearly tripled under carsales Ownership to FY22.

These international marketplaces offer fertile ground for carsales to deploy its expanded product portfolio and advanced technology. Currently, their take-rates are only a fraction of what carsales achieves in Australia, indicating a significant potential for growth.

While realising that the full potential of these acquisitions may require time and investment, they provide carsales with a platform for long-term, double-digit growth.

“We are a growth company… we are rewarded based on achieving double-digit growth... that’s how we set our objectives and that’s what we go after every year.” Cameron McIntyre, carsales CEO at their 2021 Investor Day.

As a result, carsales offers a compelling balance between earnings growth, profitability and valuation compared to other marketplaces.

Conclusion

carsales dominates the Australian market for the buying and selling of used cars. However, it’s by no means a mature business.

Its consistent strategy of winning the audience has not just made carsales highly profitable. It has unlocked the next stage of growth.

The combination of its expanded product portfolio and significant acquisitions of established international marketplaces set it up for double-digit growth over the long-term.

It now offers a compelling blend of growth, profitability and valuation. Its continued success stems from a continued focus on customer outcomes from its founding journey nearly 3 decades ago.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.