Insights: How The New York Times Is Transforming Old Media

And What It Could Mean for Other Media Companies

Hi Everyone 👋

The New York Times (NYT) needs no introduction. Despite its brand heritage, the fabled newspaper faced years of disruption and declining revenues.

However, over the past 10 years, the NYT has been writing the playbook for how old media companies can succeed today. And investors have rewarded it.

In this article, learn about the NYT’s transformation and what it could mean for other old media companies (for example, Nine Entertainment in Australia)*.

The Insights category of articles applies learnings from Venture Journeys to larger businesses. For investors with only a few minutes to spare, here’s what you need to know about how ‘old media’ companies like the New York Times (NYT) are becoming growth companies again.

In the past, it wasn’t just content that made old media companies great businesses. It was also their distribution infrastructure. The high fixed costs of the printing press or TV broadcast spectrum were strong competitive barriers and made them local monopolies.

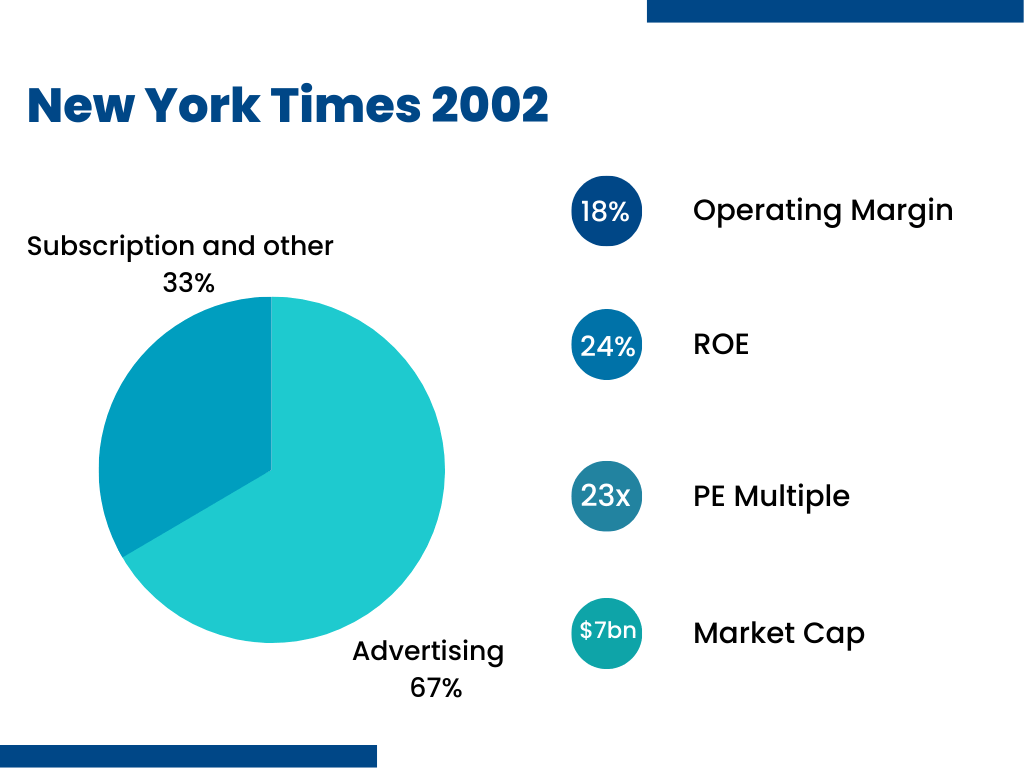

In the early 2000s, the internet changed the nature of content distribution, leading to over a decade of disruption and fleeing investors.

For the last ten years, the NYT has been writing the playbook on how old media companies can succeed in the internet age. Content, technology and a large registered audience are the building blocks of the ‘modern printing press.’

The NYT is an example of an old media business that is successfully monetising its audience. Investors have rewarded its improving financial profile with a technology-like valuation of nearly 30x trailing PE.

Such a valuation re-rating is of great interest to other old media companies. For example, Nine Entertainment (NEC) in Australia, trades at less than half the NYT’s price earnings multiple. Few businesses can match the NYT’s brand and journalism heritage. However, NEC shares similarities that could result in improving long term returns.

If you’re interested in future articles on NEC, let me know by clicking the feedback link at the end of the article.

NYT CEO Meredith Kopit Levien as profiled on the Information. *All opinions are personal. This is not investment advice.

Old Media Disrupted

There are so many lessons we can learn from international companies. But for me, what I truly appreciated was the ‘escape’ their conference calls provided during those late nights of investment due diligence.

I pictured myself in the audience, in countries I had never been to before. I felt this sense of romanticism while listening to the jazzy introductory music of the New York Time’s (NYT) investor day. I imagined the glitz and glamour of New York, while sitting at the front row of their presentation on Eighth Avenue.

The New York Times Headquarters on Eighth Avenue, New York.

Then CEO Meredith Kopit Levien mentioned these words that jolted me out of my reverie:

“This goal, importantly, reflects a shift in our emphasis from counting individual subscriptions to counting total subscribers.”

Meredith Kopit Levien, New York Times CEO

This is a remarkable statement of transformation for any old media organisation. Let me explain with some historical context.

Over 20 years ago, the high fixed costs of the printing press and broadcast spectrum gave old media companies like the New York Times (NYT) virtual local monopolies in content distribution.

Why bother to know individual subscribers when they’ve captured the attention of everyone in the area? They offered an unbeatable solution for advertisers who could be sure of reaching their audience.

Old media companies had excellent economics and would have been a core position in an equity investment portfolio.

The internet changed the nature of content distribution. The barriers to distribution that old media companies relied on for so long, gave way to internet giants like Google, Facebook and Twitter.

These new entrants didn’t just control access to consumers. They offered advertisers things that old media companies never did - targeting and measurement.

As a result, advertisers would know that their message was reaching the right audience and could measure how their advertisements were impacting their bottom lines.

Old media companies simply could not compete based on broad audience reach alone.

By 2012, old media companies were firmly in the risky ‘value’ portion of investment portfolios, if they were included at all.

The situation was becoming desperate. Something had to change, and it did. In 2012, the Sulzberger family who controlled the NYT, hired Mark Thompson.

Mark led the turnaround at BBC, re-establishing its editorial authority and overseeing its digital and international strategies. He would be instrumental in shifting the strategic direction of the NYT.

Building a Business for Subscribers

“I never believed we could have the same pricing power in digital (advertising) that we had in print… it’s an important adjunct source of revenue but I never thought it could save the Times. It had to be subscriptions.”

Mark Thompson, New York Times CEO, 2012-2020

Till then, old media companies like the NYT had a largely transactional relationship with its users. Building a subscription based business requires creating an ongoing relationship based on frequent usage and quality content.

For a 160 year old company, leading such a transformation can be a daunting task. Like most successful transformations, Mark leveraged the NYT’s greatest asset, its brand authority and journalism heritage.

“The question is fundamentally about willingness to play… The better stuff, discerning users will pay for…Why can’t we be the first successful general-internet news provider and prove willingness to pay?”

Mark Thompson

The great thing about news is that fresh content gets generated every day. The NYT’s journalism assets produce a mix of breaking news, trending topics and journalistic projects such as their collaboration with the Washington Post on the Pulitzer Prize winning series of articles on Russian interference in the 2016 US Presidential election.

The goal was to leverage their news and journalism content and a portfolio of lifestyle content to create an entertainment product that is used frequently.

An engaged user base is the crucial building block to monetisation. The NYT’s paid digital subscriptions began to grow and accelerated in 2018 with their registered user strategy.

How The New York Times Monetised Its Subscribers

“You see that inflection point after 2018 when we launched our registration model, when we require readers to register much earlier in their journey in exchange for access to additional articles.”

Hannah Yang, New York Times Chief Growth Officer

User registration is a crucial point in the customer journey. Registered users allow the NYT to understand their unique preferences by observing their behavior while they are logged on.

The ability to create engaging and customised experiences from this information is just the beginning. It also feeds into their machine learning and data science models which evaluate their willingness to pay.

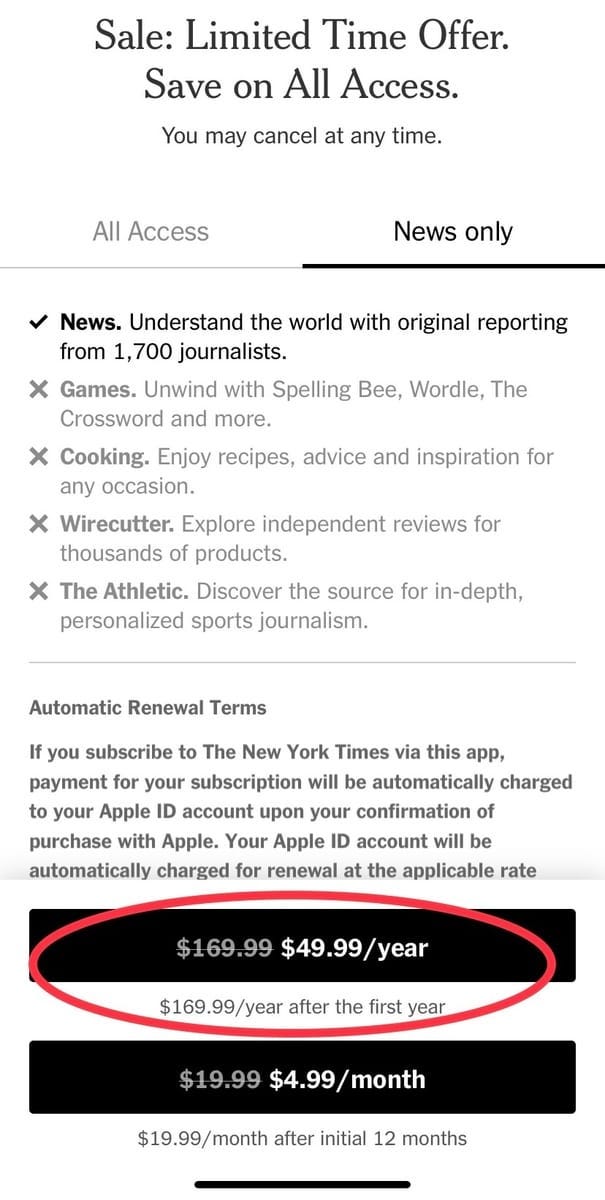

Thanks to its data models, the NYT has perfected ‘flexible paywalls’ or converting customers with promotional introductory prices that rise to full rates over time.

The results were impressive.

Registered users were 40x more likely to convert to paying customers

Over 50% of registered users convert to full-price after the expiry of their introductory offer

Subscriber acquisition costs reduced by 50% since 2018

Additionally, a large number of registered users (and the first party data generated from observing their preferences) created the foundation of an attractive digital advertising business.

“First party data has been a real unlock for us. It’s built on this foundation of registrations, 135 million now. And so that’s only made our data more powerful and our ads more performant and attractive for the market.”

Lisa Howard, New York Times Global Head of Advertising

By 2016, the bleeding had stopped and growth began to accelerate after 2018.

By 2022, the NYT had proved their model worked. It was time for the next stage of their growth journey.

Long Term Growth: How Old Media Is Relevant Again

CEO Meredith’s focus on subscribers rather than subscriptions marks an exciting shift towards a bundled pricing model.

Bundled pricing is a highly profitable model used by a wide variety of industries such as cable TV and technology. Customers pay more and have higher retention.

It works well in media because the costs to the company of replicating an article are negligible. For the consumer, this is good news.

“We expect we’re going to get continued accretion on ARPU…really about moving people up from a single product or multi-product that has a heck of a lot more value”

Roland A. Caputo, New York Times Chief Financial Officer

My subscription offers from the NYT. Note the initial promotional pricing and substantial discount from the All Access bundle.

Why now? The competitive advantage of old media companies has always stemmed from their distribution. In the past, they relied on their expensive printing presses and broadcast licenses to lock in customers.

This time, the NYT has rebuilt their distribution engine for the internet age. Their sizable registered audience, content and technology have replaced their reliance on the printing press. Bundled pricing represents the next stage of monetising their audience.

The new printing press: Leveraging technology, content and customer data. Source: Venture Journeys, 2022 Investor Day Presentation

“We have tremendous potential to attract and retain a larger subscriber base driven by a model that we think is fundamentally competitively advantaged … and we expect that model to drive Adjusted Operating Profit expansion, even as we continue to invest for growth.”

Meredith Kopit Levien, New York Times CEO

The result is a business with growth drivers that more than offset the declines in their legacy print business. After years of disruption, the NYT has shown how old media companies can be relevant again. At a price to earnings multiple of nealy 30x, investors have taken notice.

How old media is relevant again: The NYT has re-rated and is now in the growth portion of investment portfolios.

Such a valuation re-rating is of great interest to other old media companies, like Nine Entertainment (NEC) in Australia, which trades at less than half the price earnings multiple?

Few old media companies have the brand heritage or journalism strengths of the NYT. However, these 2 businesses share important similarities. Media company NEC was an early mover in Australia in building a registered audience.

If you’re interested in an article on NEC, let me know by clicking the feedback link below.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.

I’d love to hear your feedback!

Thank you for being a subscriber and best wishes!

Raveen