Lessons from Amazon's journey

Building a Defensible Business through Efficient Growth

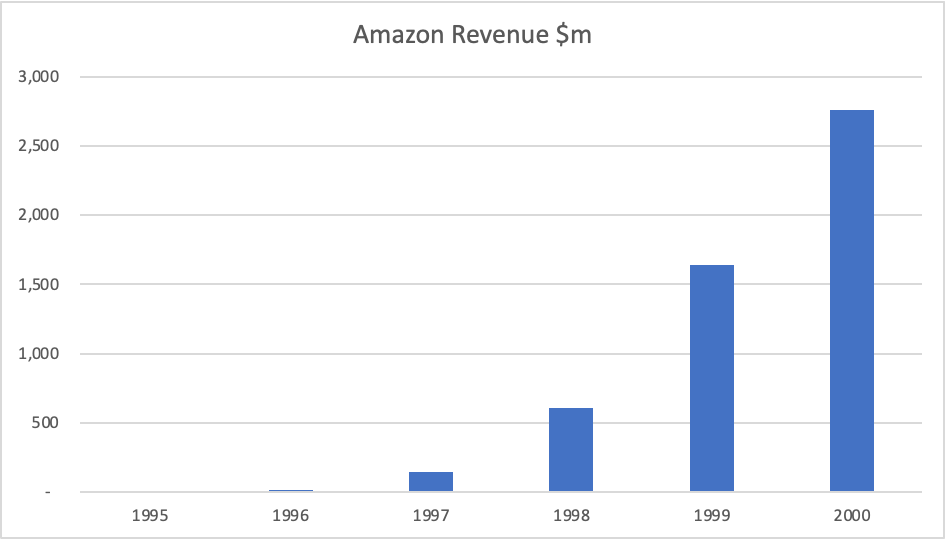

Amazon is one of the most defensible businesses on the planet. Over the past 2 decades, its revenue has grown at nearly 30% per year and it has a US$1.2 trillion market capitalisation. What’s the secret behind its success?

Before Jeff Bezos became an entrepreneur, he was an investor at a pioneering quantitative hedge fund, DE Shaw. The scientists and mathematicians who worked there envisioned the business models that would win in the emerging internet era. It was here that Jeff developed the idea that would become Amazon.

There are 3 parts to Amazon’s success and defensibility:

Providing a customer centric offering that existing physical store incumbents could not match.

Building an efficient business model that allowed Amazon to grow with positive cashflow economics.

Reinvesting this efficiency into proprietary assets that are the source of its pricing power. Examples include logistics, membership programs and cloud computing.

While Venture Journeys is yet to be DE Shaw, the rise of artificial intelligence (A.I.) and its disruptive potential, bring the lessons from Amazon's journey into sharper focus. Understanding these lessons becomes increasingly crucial if we aim to invest in businesses that are poised to succeed in this new era.

“A.I. is going to be debated as the hottest topic of 2023. And you know what? That’s appropriate. This is every bit as important as the PC, as the internet,”

Bill Gates, Microsoft founder.

Let’s dive in.

DE Shaw and the Origins of Amazon

Nearly 40 years ago, most people could not guess how the internet would change nearly every aspect of their lives in the space of just a generation. David Elliot Shaw was one of the few who tried.

In 1988, this professor from Columbia University founded the pioneering quantitative hedge fund, DE Shaw, with $28m of assets under management (this stands at $60bn in December 2022).

Staffed by scientists and mathematicians, his firm attempted to predict the winning business models of the internet era using mathematical models and game theory. In fact, DE Shaw was among the first Wall Street firms to register its website address in 1992, 3 years before Goldman Sachs.

In 1990, Jeff Bezos became one of David’s early recruits. Jeff graduated summa cum laude in electrical engineering and computer science from Princeton University. David recognised Jeff as a rising star and chose him to to spearhead DE Shaw’s internet initiatives.

Their weekly brainstorming sessions led them to a compelling realisation: the winning business model would revolve around a company that harnessed the internet's power to connect customers with suppliers across a vast array of products.

Such a company’s key advantage over physical stores would be the wider selection of items it could offer customers. This was the concept behind “the everything store”.

At the very dawn of the internet era, DE Shaw understood how powerful businesses that could aggregate demand and supply would become. Such a business model would power some of the internet’s most successful businesses and would be the secret to success in eCommerce.

“The idea was always that someone would be allowed to make a profit as an intermediary. The key question is: Who will get to be that middleman?”

David Elliot Shaw, founder of DE Shaw

There was one glaring issue. To attract customers, this company would first need to offer a comprehensive supply of items. It's a tough ask for an internet website no one had heard of.

The Amazon we know today has been methodically solving this over the last 3 decades. But it all began with a simple category, books.

The Everything Store - How Books Were The Perfect Category

Selection is the key to success for intermediaries on the internet. Customers perceive you as the place where they can purchase whatever they are looking for. However, it is expensive to build a comprehensive selection. Jeff Bezos found a solution by identifying a category that met two crucial criteria:

A category with an extensive range of suppliers that no physical store could possibly stock entirely.

A category in which Amazon could easily aggregate suppliers.

Books were the ideal choice, as Jeff later explained:

“I started ranking them, and I picked books because books are super unusual in one respect: There are more items in the book category than in any other category. There are three million different books in print around the world at any given time. The biggest bookstores only had 150,000 titles. So the founding idea of Amazon was to build a universal selection of books in print.”

Jeff Bezos, Amazon Founder

Moreover, a significant portion of book titles could be sourced from just 2 major distributors, Ingram Book Group and Baker & Taylor. As for the remaining titles, Amazon showcased the customer obsession that remains a hallmark of the company today.

Former Amazon Senior Software Engineer, David Whitney, recalled,

“If you wanted a book, you could call up Amazon and talk to a customer service rep who probably had a master's degree in Literature and could talk at length about what you might like to read. Customer service is still good, but it is nothing like it was in the 90’s. Every stray English major in Seattle got a job at Amazon Customer Service”

David Whitney, Former Amazon Senior Software Engineer.

Customers loved it and Amazon grew quickly.

As Amazon grew, it developed its sourcing and logistics capabilities. However, this was getting expensive. To help pay for these capabilities, Amazon launched its 3rd party marketplace in late 2000.

How The Marketplace Model Powers the Everything Store

Becoming a marketplace was a pivotal point in Amazon’s history. It was a scalable solution to its promise of providing customers with the best selection of products. Sellers provide the inventory and pay a fee to Amazon.

The expanded selection proved to be a magnet for more customers, in turn attracting a growing number of suppliers. This virtuous cycle unleashed powerful network effects, fueling Amazon's growth.

Fast forward to today, Amzon's third-party marketplace represents the majority of its eCommerce sales. The success of this model extends beyond mere growth; marketplaces are renowned for their remarkable efficiency as well.

Efficient Growth and Pricing Power

A marketplace leverages the efforts of its suppliers and consumers to drive its growth. Consider the capital efficiency of Amazon’s marketplace compared to an eCommerce company like Wayfair from 2013 to 2022.

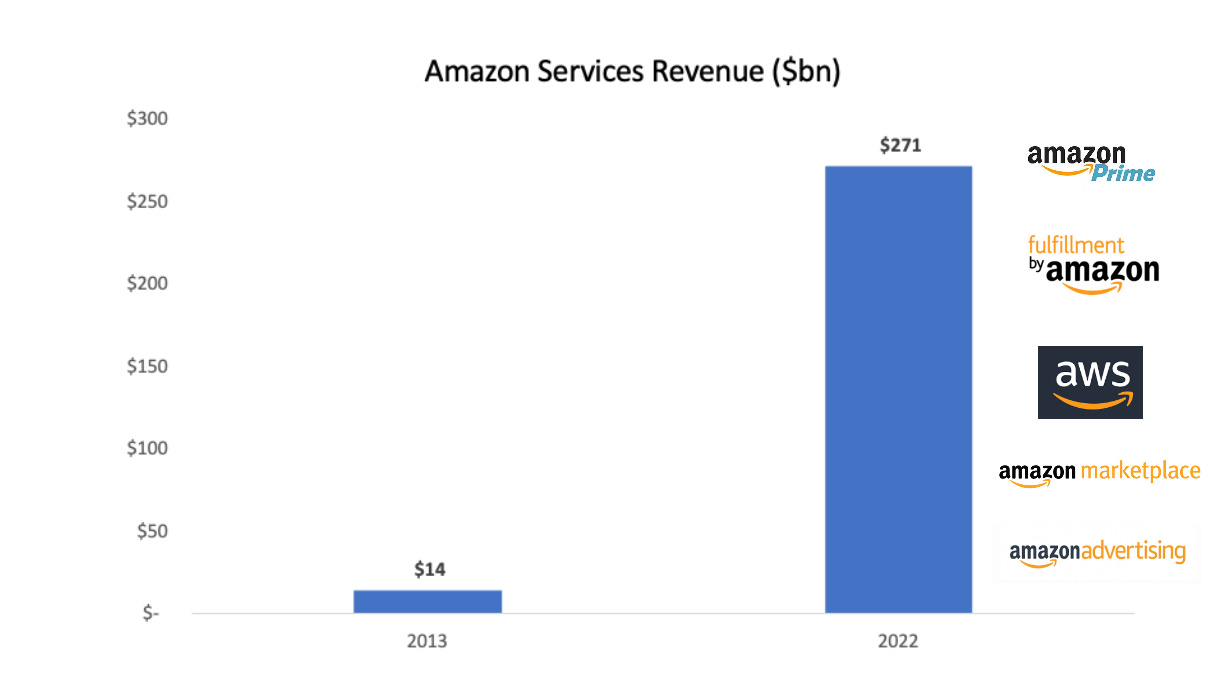

Amazon is over 4x more efficient at generating sales while spending nearly 3x more on capital expenditure. It is this capital expenditure (rather than just marketing) that allowed Amazon to build proprietary long term assets that underpin the defensibility of the business.

While many eCommerce businesses find themselves compelled to allocate increasing portions of their cash flow to digital marketing (where established players like Google and Facebook capture the lion's share of value), Amazon's strategic investments have yielded remarkable new ventures such as Amazon Prime, AWS (Amazon Web Services), and Fulfillment by Amazon logistics operations.

The true pricing power and growth potential of Amazon stem from these service-based businesses (now over 50% of Amazon’s revenue) rather than their revenue from traditional eCommerce products. During the 4th Quarter earnings call, CEO Andy Jassy shed light on Amazon's latent pricing power, stating:

“If you step back and think about a lot of subscription programs, there are a number of them that are $14, $15 a month really for entertainment content, which is more than what Prime is today. If you think about the value of Prime, which is less than what I just mentioned, where you get the entertainment content on the Prime Video side and you get the shipping benefit … that is remarkable value that you just don't find elsewhere.”

Andy Jassy, Amazon CEO

Conclusion

Nearly 30yrs after its founding, Amazon has grown to be one of the most defensible businesses in the world.

Amazon grew exponentially with a customer centric offer that incumbents couldn’t match. However, it’s not just about growth. Rather, it’s about efficient growth. The capital efficiency of its business model allowed Amazon to invest in proprietary assets that are the source of its pricing power today.

At the dawn of the internet, a New York quantitative hedge fund foresaw one of the most triumphant business models of the digital era. Now, as we face another disruptive technological revolution fuelled by A.I., the lessons from Amazon's remarkable journey become even more pivotal for any investor. They hold the key to identifying and investing in businesses poised to thrive in this new era of disruption.

Venture Journeys articles are provided for informational purposes only and should not be construed as investment, business, legal or tax advice. Please do your own research or consult advisors on these subjects.