Exploring Crypto - Defi 101, Saving with Minke and Defi's Potential

What is defi? As someone new to crypto in these volatile times, defi can be intimidating. However, this makes it a great time to learn. In this article, I break down key concepts and illustrate my first defi savings deposit with the Minke wallet.

Defi is still early in its evolution. Like most industries at this stage, it is complex, risky and likely to see increasing regulation. Simple, transparent solutions are needed for defi to become mainstream. This will enable it to reach the people who need it most.

My take is that defi’s greatest impact will be on people in countries like Brazil who face significant currency devaluation. To these people, access to a global reserve currency like the US dollar could change lives. Minke is speaking directly to this need – literally, it has just offered its app in Portuguese.

This is my fifth article in the Exploring Crypto series which details my journey into crypto. I hope sharing my experience will help others as we learn about crypto together. The views represent my own opinions and are not financial advice.

Contents

What is defi?

Composability – Fuelling the Defi Rocketship

My First Deposit on AAVE with Minke

Regulation – What follows growth

Emerging Countries – The promise of defi

What is Defi?

Decentralised finance or defi refers to providing financial services using smart contracts in place of centralised financial institutions like banks. These smart contracts basically use computer code to enforce agreements instead of relying on banks. Where do defi applications sit in the crypto ecosystem?

As previously discussed, we can group crypto businesses according to layers in a computing stack. Smart contracts are built on top of backend blockchain networks like Ethereum. Examples of defi applications are the borrowing and lending platform AAVE and stable coins (see my previous article) like USDC. This is illustrated below:

Using this computing stack analogy, applications built on a common backend tend to be compatible with one another. This is an important aspect of defi called composability.

Composability – Fuelling the Defi Rocketship

Composability of defi applications refers to their ability to interact with each other. For example, a USDC stable coin can be used on AAVE’s borrowing and lending platform. This is called composability or the popular defi term ‘money legos’. How does this work? I will use the Ethereum network as an example since it is the most popular defi network.

The Ethereum network has the ability to support smart contracts. A token is a standardised version of these contracts that represents digital assets. A popular token used in defi apps is the ERC 20 standard for fungible tokens. This standard has common rules such as how tokens can be transferred, how transactions are approved etc. Designing their tokens around a common standard allows defi applications to work together.

Why is this a big deal? It provides the building blocks for applications that would send defi into the stratosphere.

Yield Farming- The Defi Rocketship

An important use case for composability is yield farming. In yield farming, token holders aim to maximise returns using various defi platforms.

Defi took off in mid 2020 due to the launch of the Compound token (COMP). Compound, like AAVE, is a borrowing and lending platform. In 2020, it released its governance token COMP. The token rewards users for providing capital and using the platform.

Given composability (e.g. common ERC 20 standards), these tokens can be used in other defi applications for additional yield. Governance tokens significantly increased the potential returns from lending and popularised yield farming. E.g. a lender gets rewarded with interest payments as well as the ability to use governance tokens to earn returns on other platforms.

Other defi applications replicated this feature resulting in the defi market growing from US$4 billion in August 2020 to over US$100 billion in just 8 months as shown below.

Some of the most popular defi apps are included in the table below:

Yield farmers can create complex strategies to maximise yields by combining these platforms. To illustrate this, I’ve included an example from Furucombo, an application that helps users create yield farming combinations.

Instead of the above complexity, this article will focus on a simple application - saving on AAVE with Minke.

My First Deposit on AAVE with Minke

AAVE is a defi lending and borrowing application. Rather than simply matching individual lenders and borrowers, AAVE uses a liquidity pool system. Liquidity pools are a common feature in defi. Lenders deposit their assets into different crypto pools. Borrowers can then borrow from these pools with interest rates determined by demand and supply.

For example, I want to deposit 100 USDC in AAVE’s USDC liquidity pool. AAVE creates 100 aUSDC tokens which represents my deposited USDC. The liquidity pool lends out USDC tokens to borrowers, who pay interest according to the demand and supply of USDC.

My aUSDC tokens also earn interest from the pool as shown below.

Depositing funds and saving on AAVE require a number of steps. For example, I need to connect my Metamask wallet to AAVE’s website and navigate its numerous options.

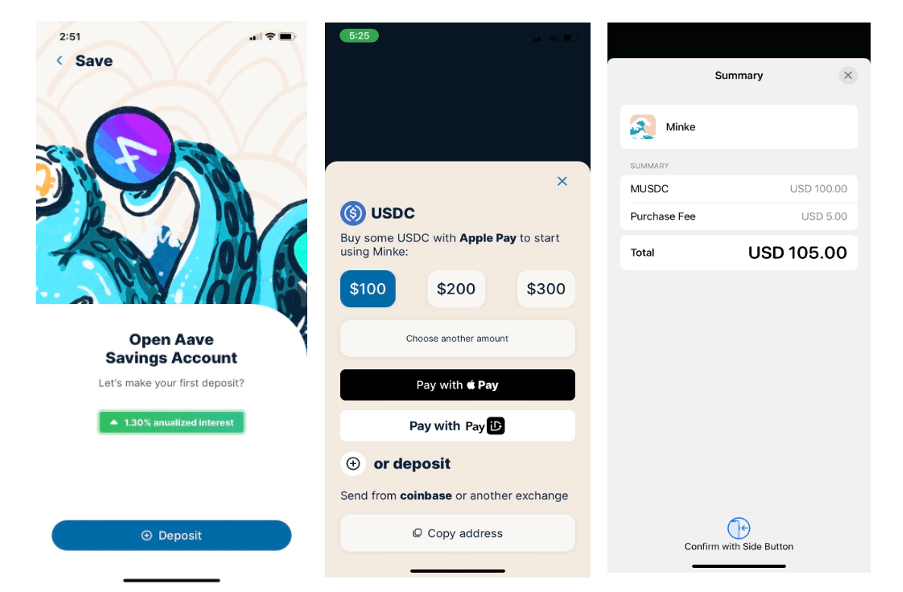

In contrast, Minke feels like a normal mobile app with easy-to-understand options. I purchased USDC with a few simple clicks.

Minke charges 0.5% in fees per transaction on the app. The rest of the purchase fees goes to payment processors like Apple Pay and Wyre. There are also cheaper payment processor options such as PayId.

As a non-custodial wallet, Minke does not hold any funds. Instead, it connects my wallet to the underlying defi application. Its default savings option is mStble but I’ve chosen AAVE to illustrate a popular defi platform. This is not financial advice.

Minke’s simplicity is the result of intentional design choices which I will cover in my next article.

Currently, AAVE is offering deposit rates of around 1% pa for USDC tokens. This is far higher than what is being offered by US banks for US dollar deposits. Sounds good right?

Not so fast! As with any savings product, it’s not enough to consider how much interest I will earn on my deposit. Another key question is: how safe is my deposit?

Overcollateralisation – Not for the rest of us, for now

Have you ever taken a loan from a bank? You are asking the bank to give you cash upfront with a promise to repay them in the future.

The bank’s confidence in your ability to repay comes from your:

Collateral against the loan. For example, your house, car etc against which you took the loan against.

Ability to repay the loan. For example, based on your employment history, income etc. Importantly, the lender’s ability to pursue you directly is a strong motivator to repay the loan.

Defi lending on applications like AAVE is anonymous. This means the borrower cannot be pursued for defaulting on the loan.

As such, defi lending relies heavily on overcollaterlisation. This means borrowers need to provide more capital than the amount borrowed. Over 40% more according to Vinay Kumar, founder of Hashstack Finance. Imagine having to deposit $140 to get a loan of $100!

Why would a borrower agree to this? The reason is speculation that her/his crypto currency will appreciate in value. As a hypothetical example, say the borrower is excited about the prospects of cryptocurrency Ether (Eth) and wants to own more:

Step 1: Provide $150 worth of Eth to AAVE as collateral.

Step 2: Borrow $100 worth of USDC.

Step 3: Use the $100 USDC to buy $100 worth of Eth

In the above example, the borrower has turned her/his $150 Eth position into $250 Eth.

The issue is, speculation is a risky endeavour. For example, defi savers are exposed to higher risk compared to a large bank in Australia. Depositors in Australian banks enjoy government guarantees as well as long term debt and equity support.

Additionally, composability can be a double-edged sword. Composability makes defi applications more interconnected. However, this also exposes each application to the risks of the application that it interacts with.

This can be seen in defi application Celsius’s recent struggles in this Twitter thread.

My view is that we are at an early stage in defi and this comes with higher risk. So, it’s important to do your own research.

Overcollaterlisation is an important problem to solve as it keeps most borrowers out. For example, it does not make sense for a business owner to take an overcollateralised loan for her/his business.

Some companies like Reputation DAO are attempting to solve this by linking defi with the borrower’s real-world identity. I believe that such innovations, along with applications with intuitive and simple user experiences would help take defi mainstream.

Another sign of early-stage growth is the prospect of more regulation.

Regulation - What follows growth

Defi is challenging to regulate due to its decentralised nature. Typically, regulators tend to focus on intermediaries such as banks. For example, it is easier to regulate large banks rather than millions of borrowers and depositors. How would they apply this in defi?

With defi, the regulators are focusing on certain crypto on-ramps. These are platforms where fiat currency is exchanged for cryptocurrency. Specific examples include cryptocurrency exchanges like Coinbase and stable coins.

One focus of regulators globally is for crypto service providers to attach customer identification information to transactions. For example, provide customer name and address information. The aim is to prevent criminal activity such as money laundering.

This regulation can have implications for non-custodial wallets like Minke. Customers with a non-custodial wallet own their private keys and are anonymous. Complying with these regulations could increase costs and result in short term disruption.

The regulation here is evolving and needs to be watched closely. However, regulation is to be expected as an industry grows. If done correctly, it makes industries more transparent, accountable and safer. This is an important step towards democratising defi, including bringing it to the millions of people who need them most.

Emerging Countries – The promise of defi

Imagine you have been saving responsibly for years. Then one day, you’re not able to withdraw your cash. Or worse, you found your savings converted for you into government investments of dubious value. How would this impact where you would save your money?

We may struggle to relate if we live in countries with strong currencies and stable economies like Australia. However, the above actually happened in Argentina in the early 2000s and 1989. To these people, defi represents access to global reserve currencies like the US Dollar. This type of financial inclusion could change lives.

Unsurprisingly, a Gemini study found people in such countries were 5x more likely to adopt cryptocurrency in the next year.

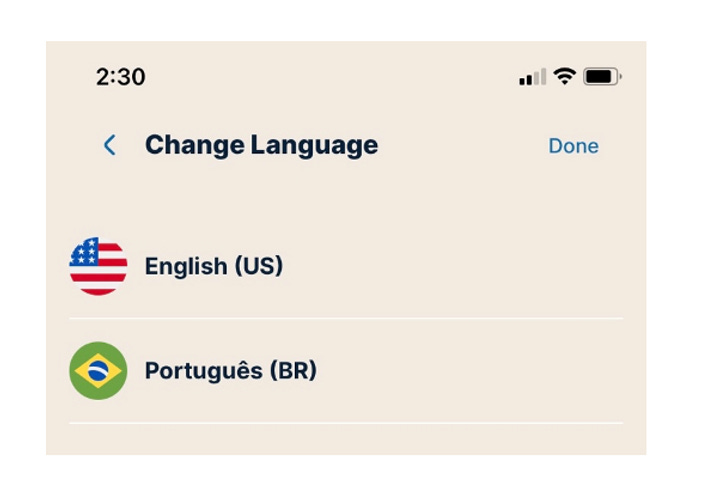

A simple, user friendly solution like Minke speaks directly to this need – literally. Minke has recently begun offering its app in Portuguese.

To me, the promise of defi is its ability to change the lives of millions in these countries. This is what providers like Minke and others are working towards.